Starting from January 1st 2024, HMRS now require selling and service platforms to regularly report your transactions to them. These records will be cross-checked with the income you’ve reported on your tax return, and any disparities may be subject to investigation.

This measure aims to combat tax evasion.

However, there’s no need to panic. Remember, you’re entitled to a £1,000 tax-free allowance for property income and another £1,000 tax-free allowance for trading income. This means that small side hustles may fall within these exemptions.

Some of the marketplaces affected by this change include Ebay, Vinted, Airbnb, Fiverr, Upwork, Uber, Deliveroo, Etsy, cat, and dog sitting.

Here’s what our Tax Manager, Amy, suggests:

If you’re already paying taxes on all your online earnings, continue as usual. Keep thorough records, even if your income falls below the threshold, as they may be necessary in case of a compliance check from HMRC.

If you’re not sure about the above, talk to an independent specialist such as an accountant.

Check out our FAQ’s page for more useful information on tax and your responsibilities as a sole trader or a limited company.

HB Accountants are there for all businesses. Feel free to contact us. We’re here to discuss how we can support you with your affairs.

The information contained above is for general guidance purposes only. Whilst every effort has been made to ensure the contents are accurate, please note that each individual has different circumstances and it is essential that you seek appropriate professional advice before you act on any of the information contained herein. HB Accountants can accept no liability for any error.

Read Our Latest Blogs Below

- HB Accountants Leads Installation of Life-Saving Defibrillator in Rye House, Hoddesdon

A potentially life-saving public access defibrillator has been installed in the Rye House area of Hoddesdon, made possible by local business HB Accountants, in partnership with local charity, Hearts for Herts, and a generous donation from Plumpton House landlord Clive Martin. HB Accountants’ fundraising … Continue reading

A potentially life-saving public access defibrillator has been installed in the Rye House area of Hoddesdon, made possible by local business HB Accountants, in partnership with local charity, Hearts for Herts, and a generous donation from Plumpton House landlord Clive Martin. HB Accountants’ fundraising … Continue reading - Cyberattacks – why FDs and CIOs need to collaborate

The growing threat of cyberattacks remains for all UK businesses. It could result in Cyber Vandalism – such as the publication of a fake terror attack at UK stations thanks to an admin error that impacted National Rail, fake voices and images – known … Continue reading

The growing threat of cyberattacks remains for all UK businesses. It could result in Cyber Vandalism – such as the publication of a fake terror attack at UK stations thanks to an admin error that impacted National Rail, fake voices and images – known … Continue reading - Why and How to Verify Your Identity with Companies House – A Must for Company Directors and PSCs

From 2024 onwards, Companies House has introduced important changes as part of the Economic Crime and Corporate Transparency Act. One of the biggest changes is the requirement for certain individuals to verify their identity to obtain a VIN number. This key step is to … Continue reading

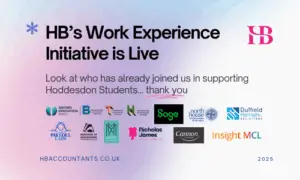

From 2024 onwards, Companies House has introduced important changes as part of the Economic Crime and Corporate Transparency Act. One of the biggest changes is the requirement for certain individuals to verify their identity to obtain a VIN number. This key step is to … Continue reading - HB Accountants Launches Inspiring Work Experience Initiative Across Borough of Broxbourne and We’re Just Getting Started!

We’re thrilled to announce that the HB Accountants Work Experience Programme has officially launched giving local students the opportunity to rotate through five different businesses over their week experiencing the workplace.

We’re thrilled to announce that the HB Accountants Work Experience Programme has officially launched giving local students the opportunity to rotate through five different businesses over their week experiencing the workplace. - Hello from Livingstone! Talking to Gertrude

Sponsoring a university student in Zambia via the charity African Impact Foundation, has been an eye-opening experience for the HB team. Gertrude is studying for her Bachelor of Business Administration in Accounting and Finance at Chalimbana University in Zambia. She took time away from … Continue reading

Sponsoring a university student in Zambia via the charity African Impact Foundation, has been an eye-opening experience for the HB team. Gertrude is studying for her Bachelor of Business Administration in Accounting and Finance at Chalimbana University in Zambia. She took time away from … Continue reading - Company Directors and Partnerships – you need to be aware of these Companies House Changes

The registration system used by Companies House is changing in 2025 due to the Economic Crime and Corporate Transparency Act. The changes are designed to prevent fraud and ensure that businesses are more transparent. If you are a director of a UK company, a … Continue reading

The registration system used by Companies House is changing in 2025 due to the Economic Crime and Corporate Transparency Act. The changes are designed to prevent fraud and ensure that businesses are more transparent. If you are a director of a UK company, a … Continue reading