A new health and social care tax will be introduced across the UK to pay for reforms to the care sector and NHS funding in England. It will raise £36bn for front line services over the next three years.

The PM accepted that this broke the pledge the conservatives made in their most recent manifesto but stated that a ‘global pandemic’ was not in any party’s manifesto.

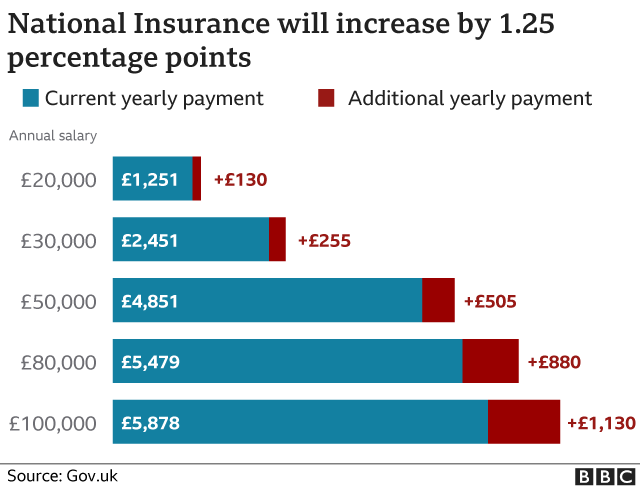

The tax will begin as a 1.25% rise in National Insurance from April 2022 paid by both employers and workers and will then become a separate tax on earned income from 2023 – calculated in the same way as National Insurance and appearing on an employee’s payslip.

Income from share dividends – earned by those who own shares in companies – will also see a 1.25% tax increase.

Proceeds from these rises would lead to £12bn a year going into catching up on the backlog in the NHS created by COVID-19, increasing hospital capacity for nine million more appointments, scans, and operations.

The money will also go towards changes to the social care system, where a cap will be introduced on care costs from October 2023 of £86,000 over a person’s lifetime.

All people with assets worth less than £20,000 will then have their care fully covered by the state, and those who have between £20,000 and £100,000 in assets will see their care costs subsidised.

If you have any queries regarding the above please do not hesitate to contact Amy on amy@hbaccountants.co.uk.

Adapted from: https://www.bbc.co.uk/news/uk-politics-58476632

HB Accountants are here to help: giving you access to experienced accountants and useful information and support no matter your business size or sector. If you would like a no obligation discussion about how we can help you and your business, please feel free to contact the team on 01992 444466.

We’re accountants for business and we’re here to help you grow.

Visit our COVID19 Business Hub for more information

View our Latest Blogs

- Why a budget helps you to focus on business growth

- How a SME Owner Can Create More Time

- A New Academic Year for our Student in Zambia

- Benefits in Kind via the payroll

- Getting a mortgage when you’re self employed

The information contained above is for general guidance purposes only. Whilst every effort has been made to ensure the contents are accurate, please note that each individual has different circumstances and it is essential that you seek appropriate professional advice before you act on any of the information contained herein. HB Accountants can accept no liability for any errors or omission or for any person acting on or refraining from acting on the information provided in the above

Feel free to follow us on Instagram to get to get a flavour of who we are @HBAHoddesdon

Pingback: What does the start of the new Tax Year mean for you? - HB Accountants