Have you heard about the Governments latest initiative to help unemployed 16-24 years olds? The Kickstart Scheme is here but is it right for you and your business? Here we explain how the scheme works, who is eligible and how to apply.

What is the Kickstart Scheme?

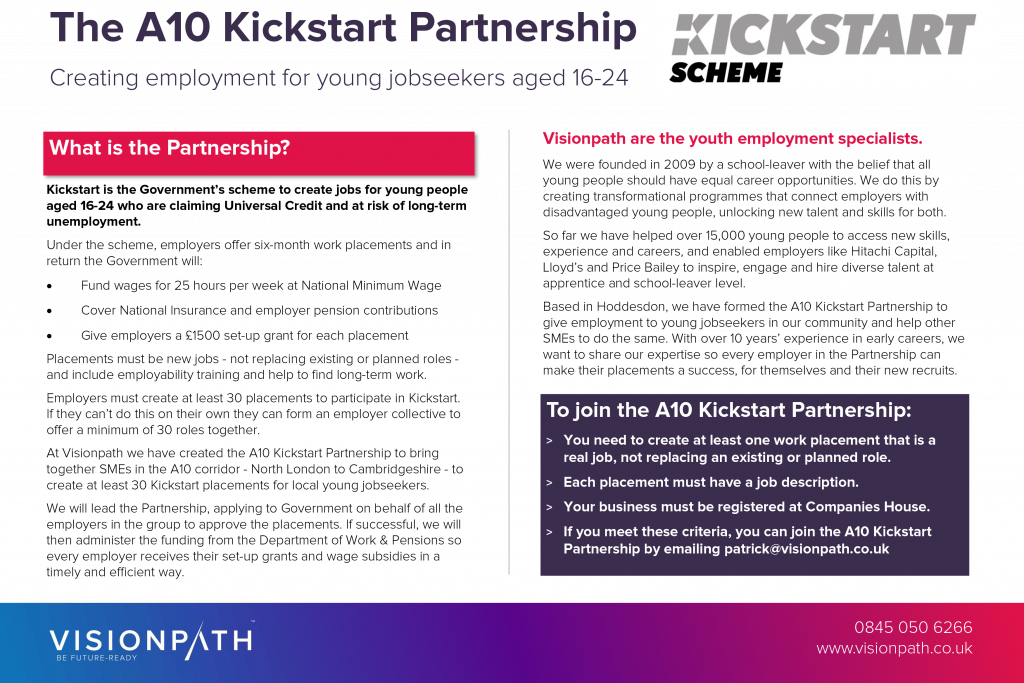

The Government’s Kickstart Scheme provides funding to employers to create new 6-month job placements for young unemployed (16 to 24 years) who are currently on Universal Credit*. If you are looking to apply for the scheme but cannot offer the minimum 30 placements, you are able to collaborate with other companies to form an “employer collective” to reach the minimum 30 placements between you.

*if you are between 16-24 years and are not claiming Universal Credit, then find out if you are eligible to be considered as an applicant for the new placements that are going to be made available through the Kickstart Scheme

Click here to find out more about Universal Credit eligibility

Am I eligible?

Any organisation can apply for the funding, no matter the size, as long as the jobs that are being created are new.

You can’t replace existing or planned vacancies, nor can you cause existing employees or contractors to lose their employment.

The roles that you create must be:

Each application should outline just how the placement will develop the participant’s skills and experience, including:

- Support to look for long-term work, including career advice and setting goals

- Support with CV and interview preparations

- Support for the participant with basic skills, such as attendance, timekeeping and teamwork

Once the placement has been created, it can be taken by someone else once the first applicant has completed their first six-month term.

What funding will I receive if I offer a placement?

A sum of £1,500 per job is also available for the set-up costs, the support and the training plus the Government will cover the NI & employers pensions contributions and fund wages for 25 hours per week at the National Minimum Wage.

· Wages funded for 25 hours per week at National Minimum Wage

· National Insurance and employer pension contributions covered

· Employers to receive a £1500 set-up grant for each placement

I am an SME and can’t offer 30 placements – can I offer just one Kickstart Scheme placement?

Yes! If you are creating fewer than 30 placements you are able to partner with other organisations to reach the minimum of 30 placements between you.

You could pair up with:

- Similar employers

- Local authorities

- Trade bodies

- Registered charities

There’s more info on this in becoming a representative for a group of employers. Alternatively, you can turn to the Jobcentre Employer Partnership Team to help you find a representative.

Visionpath in Hoddesdon, Hertfordshire have created the A10 Kickstart Partnership to bring together SMEs in the A10 corridor – North London to Cambridgeshire – to create at least 30 Kickstart placements for local young jobseekers.

HB Accountants are hoping to team with Patrick Philpott from Visionpath in Hoddesdon in order to submit our potential Kick Start application – feel free to email him for more details by clicking his name above.

Also worth mentioning, as the central point of access for business support in Hertfordshire, Herts LEP are trying to find out the number of SMEs that might require their support in order to submit an application. Get in touch with your local LEP if you aren’t in the Hertfordshire catchment.

Click here to give Herts LEP your details: click here (link to their short initial interest form – 2 mins max to complete).

HB Accountants would also recommend speaking with your local Chamber of Commerce if you are interested in joining an “employer collective”.

Useful links:

https://www.gov.uk/guidance/find-someone-to-apply-for-a-kickstart-scheme-grant-on-your-behalf

https://www.gov.uk/government/collections/kickstart-scheme

HB Accountants are accountants for business. We understand how you can make sharper, better business decisions when you really understand your financial position and we are keen to help you deliver this transparency in the best manner for your business. For guidance on whether a cloud-based accounting system would help your business, please talk to us. We’re still working hard to help you make the right decisions.

Our Covid19 hub is still available to any business that needs accounting support and our team is on hand for bespoke consultations.

Visit our COVID19 Business Hub for more information

For financial and accounting guidance and support, please contact Keith or Karen. We’re still working hard to help you make the right decisions.

Or call 01992 444466 or email directors@hbaccountants.co.uk for help. We look forward to hearing from you.

Latest Blogs from HB Accountants

- Shout out to Payroll!

- The benefits of cloud-based accounting systems for SMEs

- Furlough (CJRS) is changing – Dates for Your Diary

- JUST ONE REASON – The Power of Professional Relationships

- Quarantine Team Members – Know the Facts

The information contained above is for general guidance purposes only. Whilst every effort has been made to ensure the contents are accurate, please note that each individual has different circumstances and it is essential that you seek appropriate professional advice before you act on any of the information contained herein. HB Accountants can accept no liability for any errors or omission or for any person acting on or refraining from acting on the information provided in the above