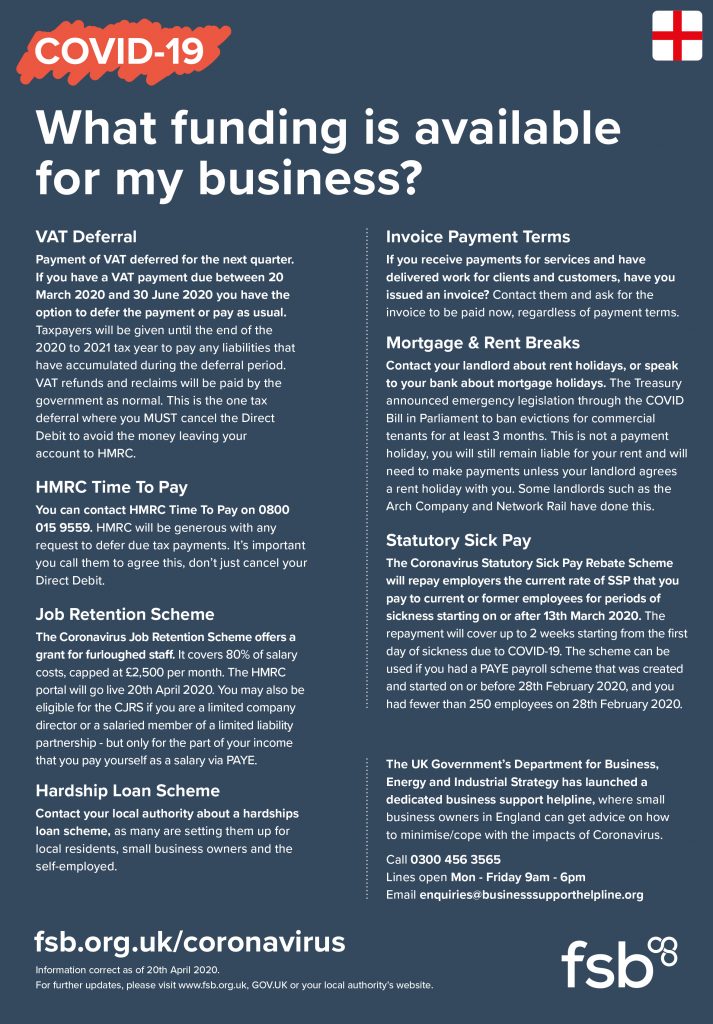

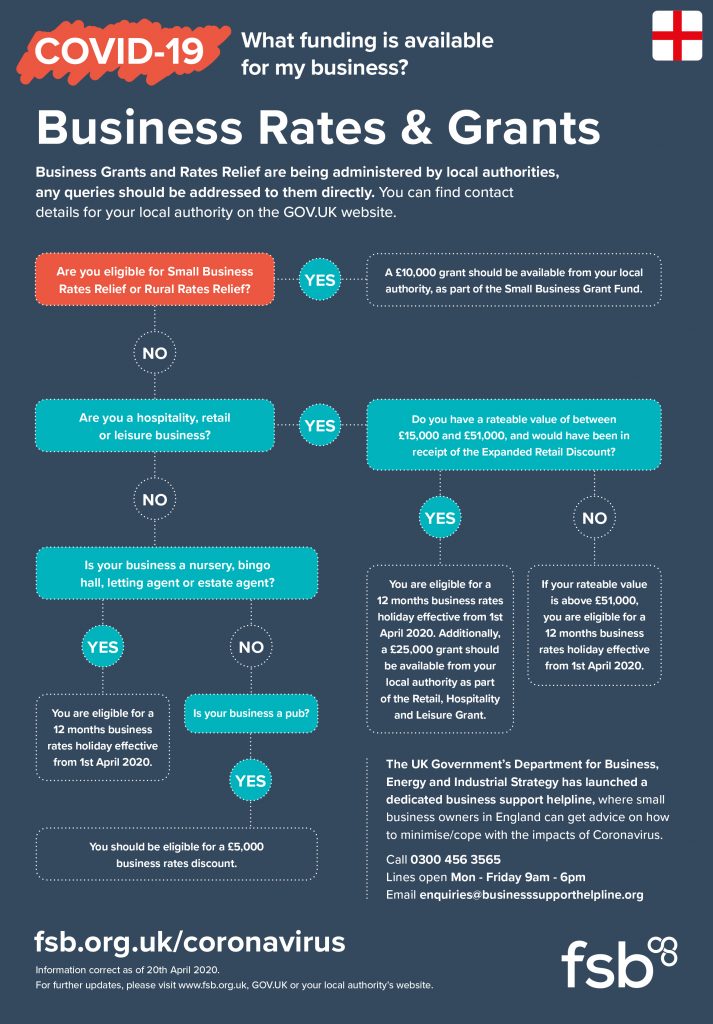

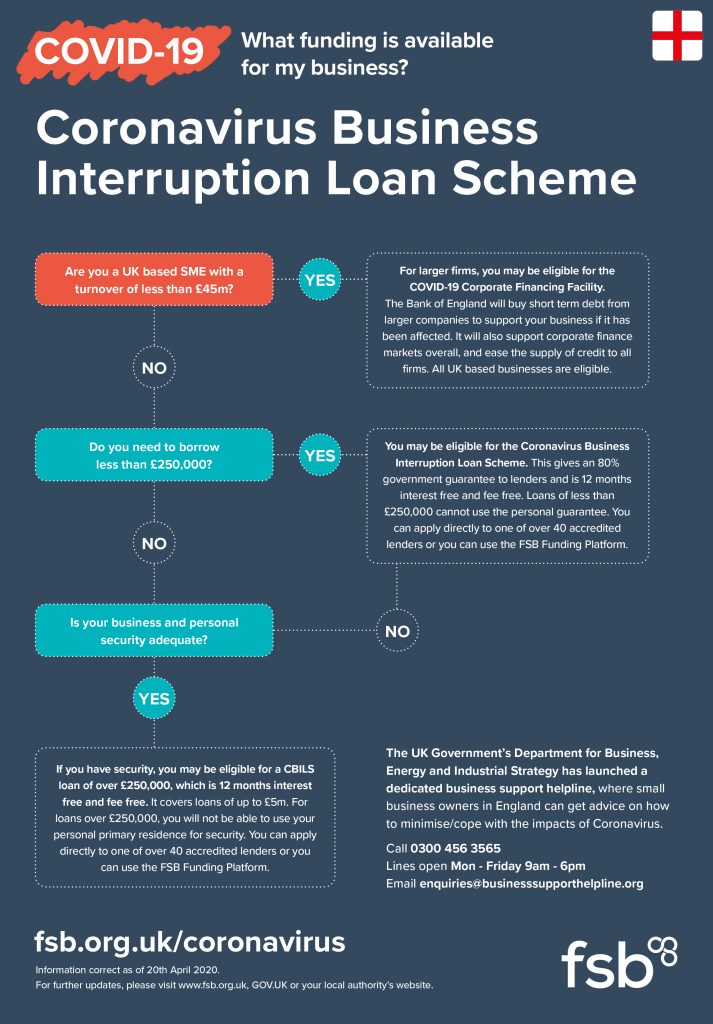

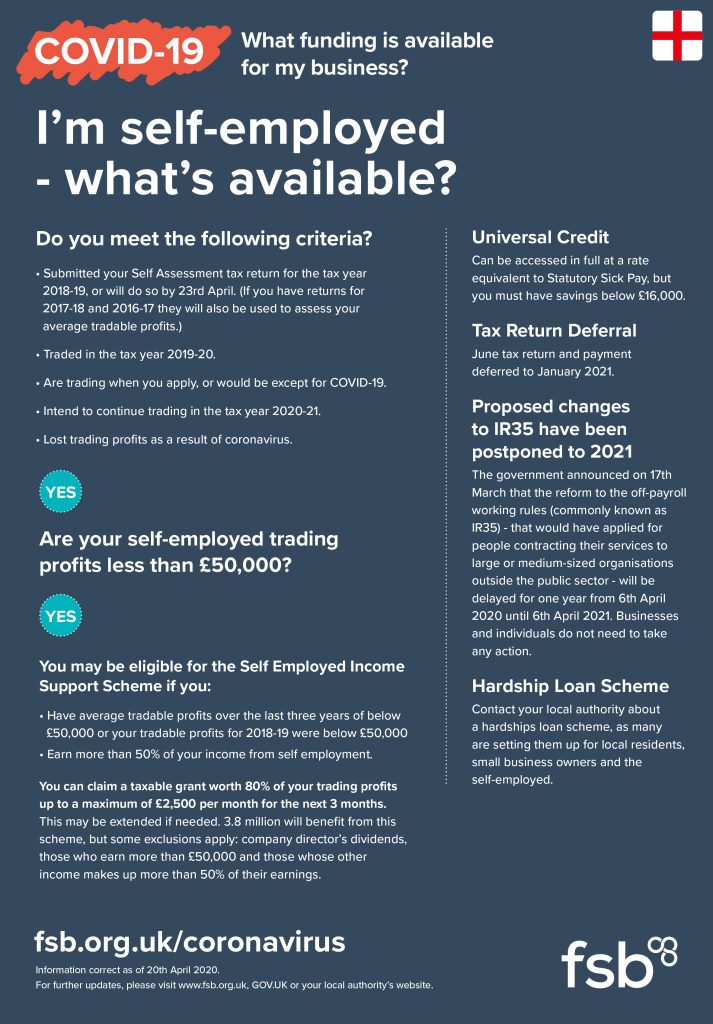

Funding options and criteria available to you during COVID19 can be complex, which is why The Federation of Small Business have simplified the process so you can easily check your eligibility for different schemes. You’ll find tailored information for businesses in England, Wales, Scotland and Northern Ireland, as well as advice on what you can access if you’re self-employed. Download the PDF guide for your home nation to get started.

COVID19 Funding for your business in England

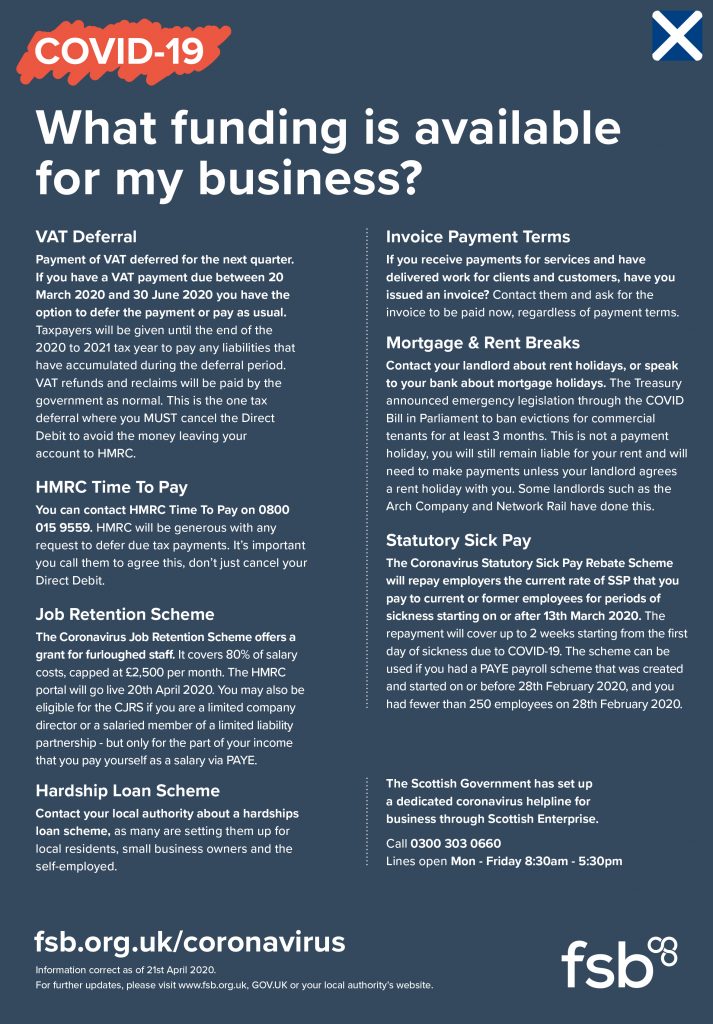

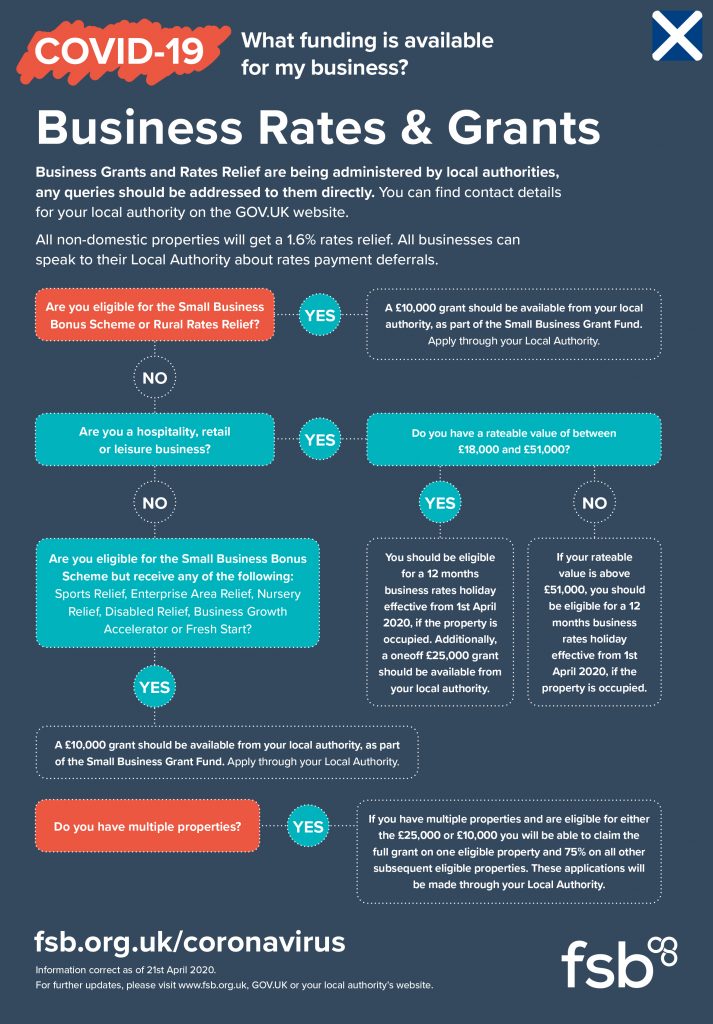

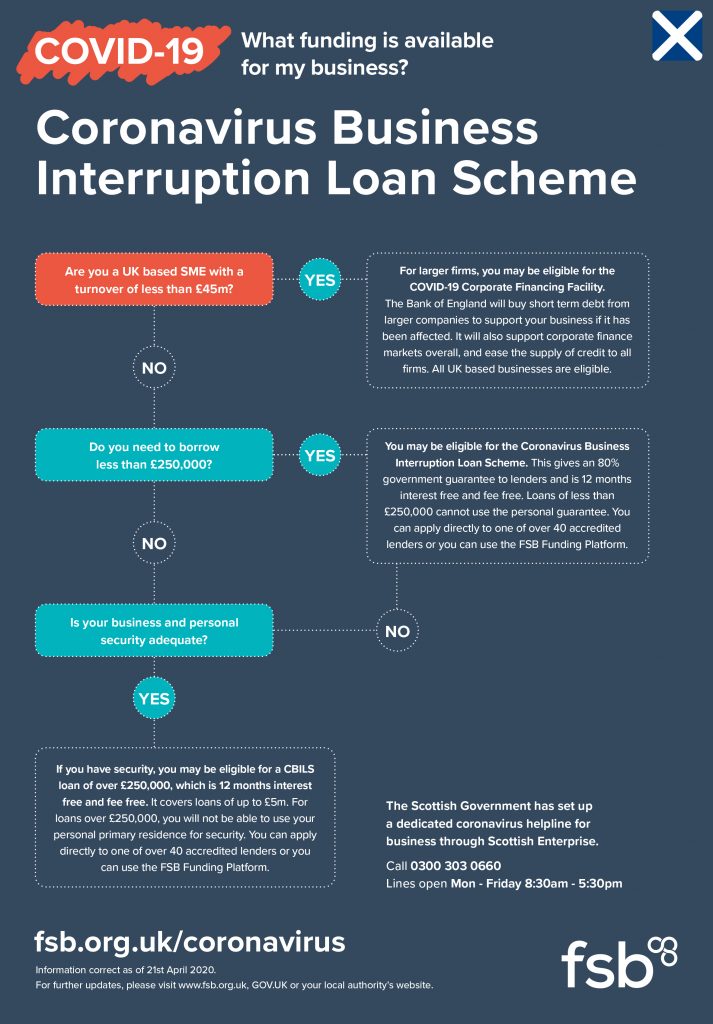

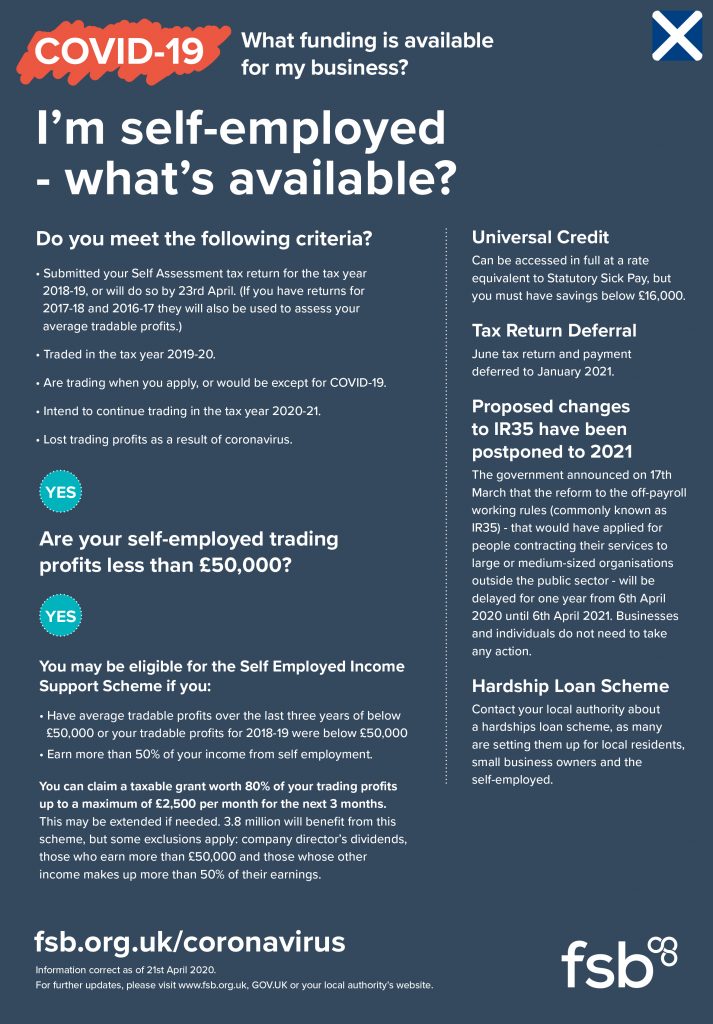

COVID19 Funding for your business in Scotland

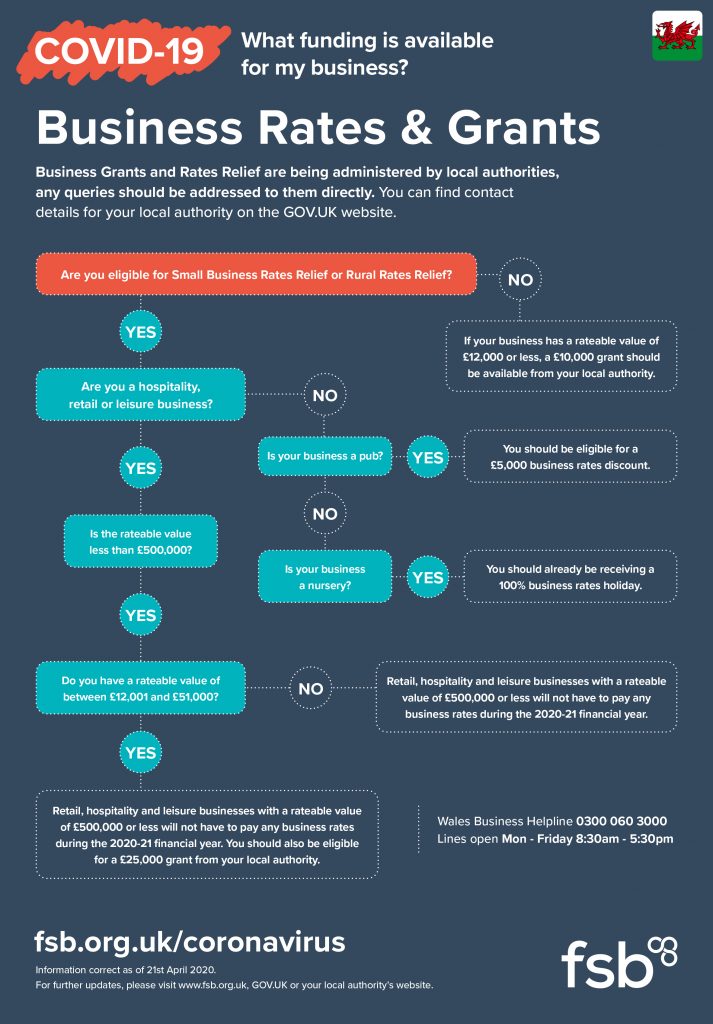

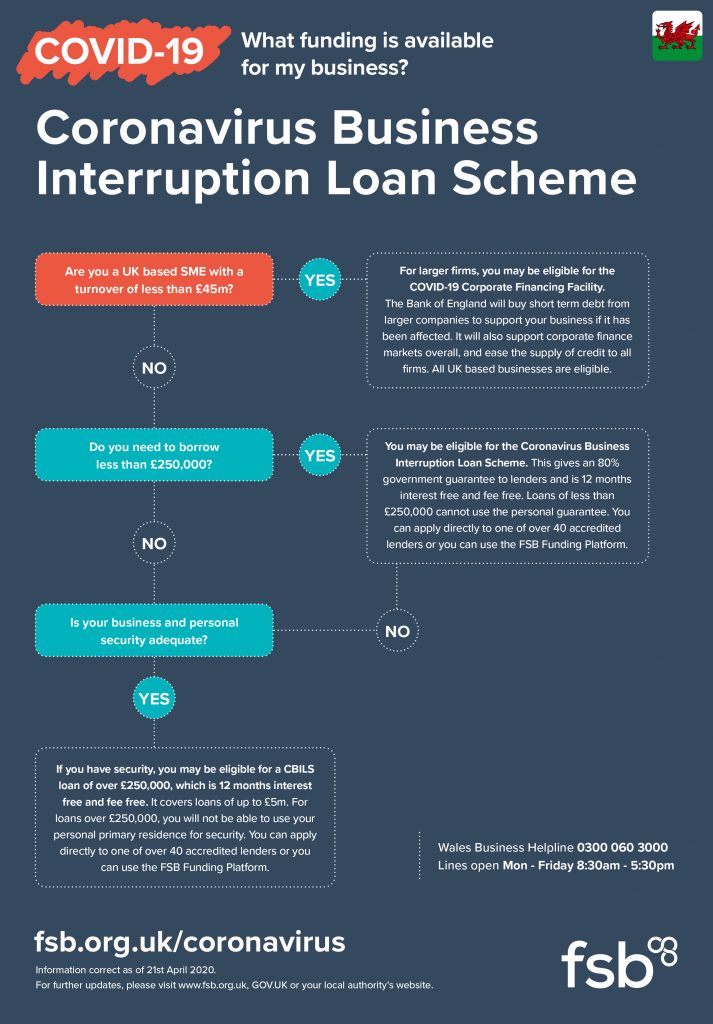

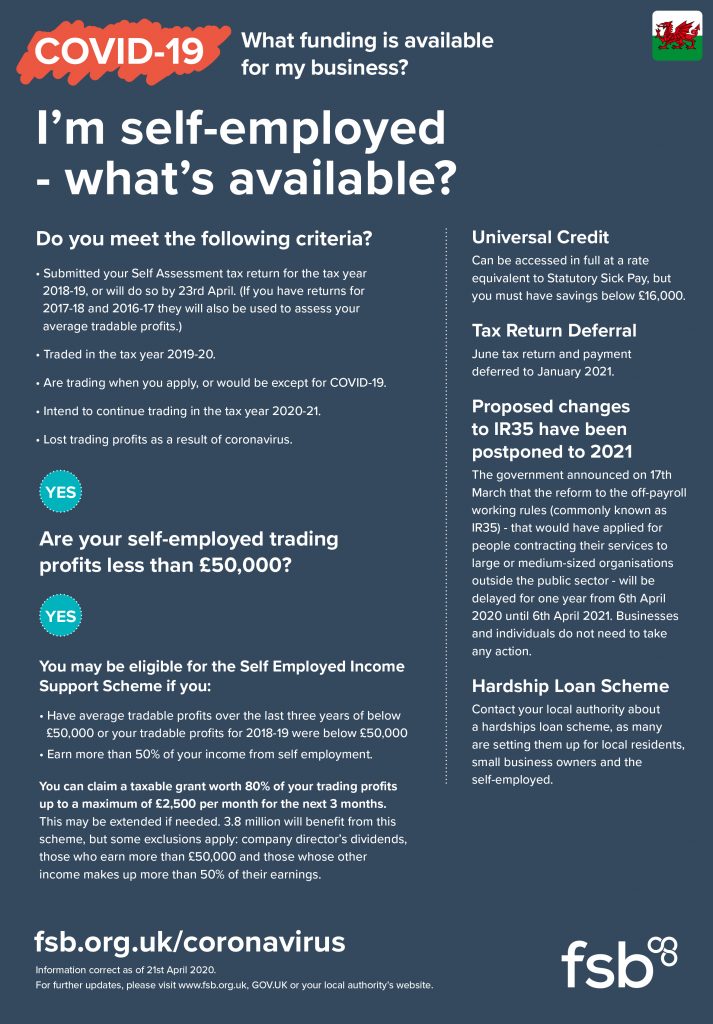

COVID19 Funding for your business in Wales

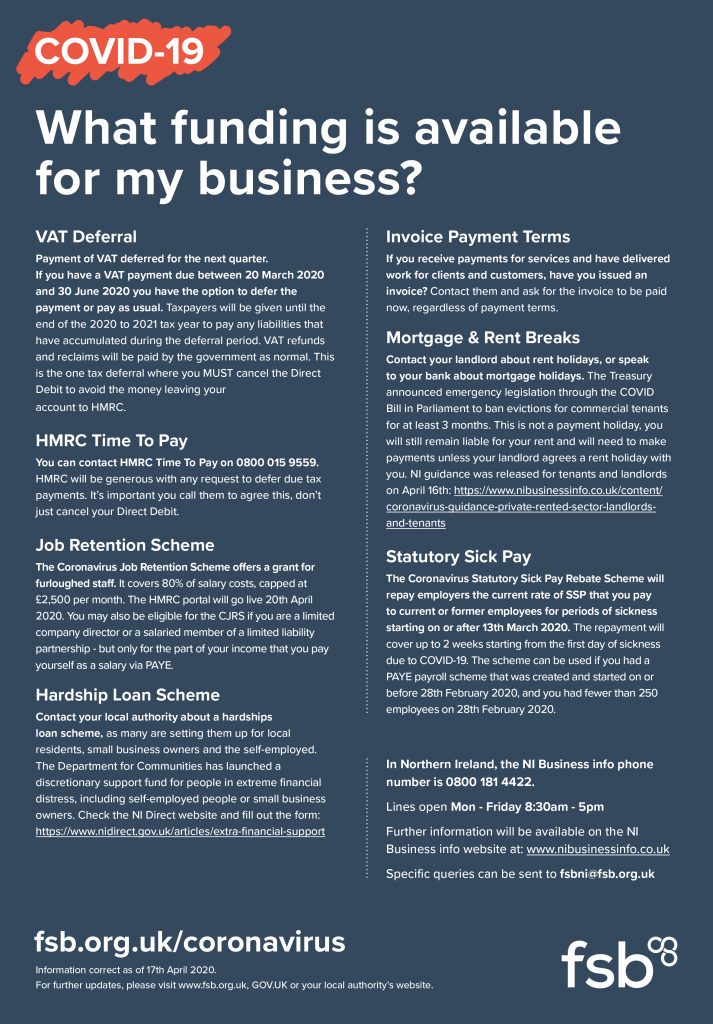

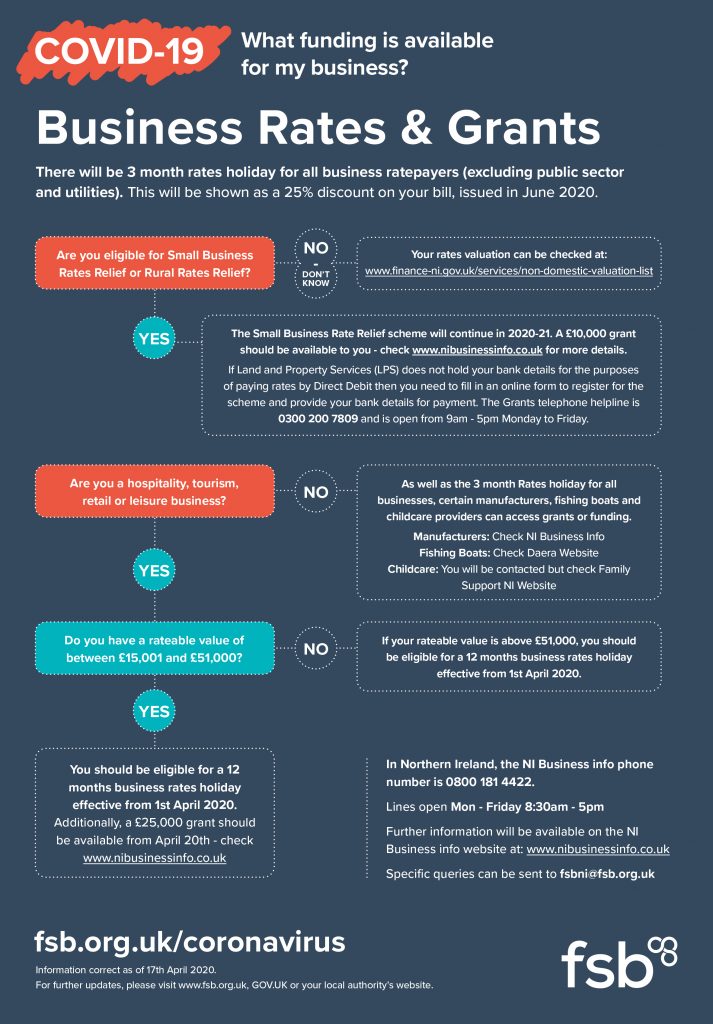

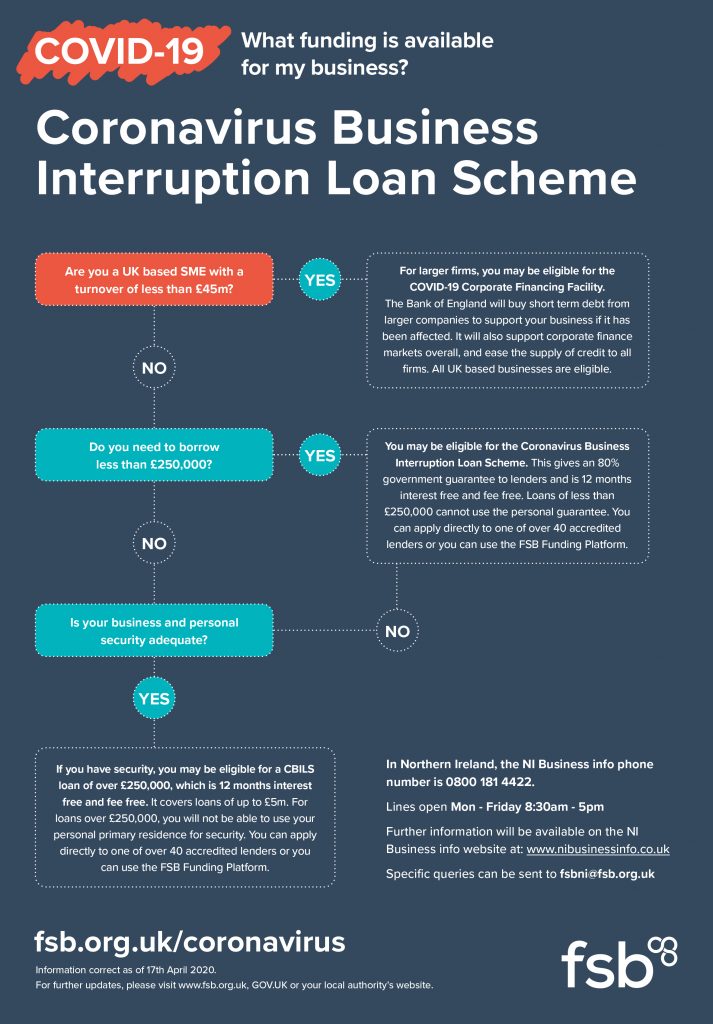

COVID19 Funding for your business in Northern Ireland

Team HB would like to thank the The Federation of Small Businesses for providing details for our summary above.

UPDATE 28 April 2020: COVID19 Bounce Back Loan Scheme – 100% government backed loan scheme for small business

Since publishing this blog, Rishi Sunak announced the new Bounce Back Loan Scheme (on 27th April 2020). Small businesses will benefit from the new fast-track finance scheme, providing loans with a 100% government-backed guarantee for lenders. If you are a smaller company who struggled to get a CBILS loan then this could be for you.

Click here for more information on the Bounce Back Loan Scheme

We hope this information helps you and we are here for you during this difficult time. We will continue to keep you updated as the Government releases new information. Our business contingency plan is in place and we will do everything we can to support our clients during this uncertain period, please do not hesitate to contact us here if you have any concerns or queries.

Visit our COVID19 Business Hub for the very latest updates and help

Latest blogs from HB Accountants

- HMRC Advisory Fuel Rates (AFRs) from 1st June 2025

- How an audit can help your business (and actions you can take to make it go smoothly too!)

- Why a budget helps you to focus on business growth

- How a SME Owner Can Create More Time

- A New Academic Year for our Student in Zambia

The information contained above is for general guidance purposes only. Whilst every effort has been made to ensure the contents are accurate, please note that each individual has different circumstances and it is essential that you seek appropriate professional advice before you act on any of the information contained herein. HB Accountants can accept no liability for any errors or omission or for any person acting on or refraining from acting on the information provided in the above