As we celebrate our 100th birthday, we thought it would be fun to look back at the history of HB Accountants. You can read part 1 – our birth – here or read about how the 2nd World War impacted us here or how we got our name here. In this blog, part 4, we revisit what life was like for an articled clerk, learning his trade as an accountant.

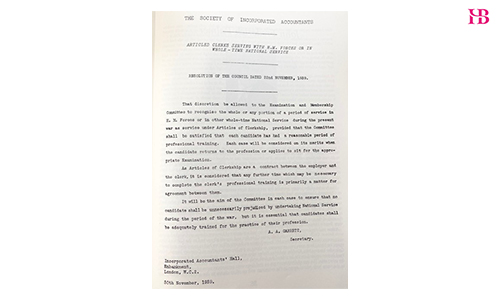

In the 1950’s there were two principle bodies of Accountants: The Institute of Chartered Accountants and The Society of Incorporated Accountants. The difference was that to become a Chartered Accountant, you had to first be Articled – which took five years and three examinations – whereas for the Incorporated Society, a young man could serve seven years in a professional office instead.

One Articled clerk at that time was John Palmer, son of HB partner Arthur Palmer, a position that John himself would eventually hold at HB. Back in the early 50’s, John earned £2.10s per week from working in the Clerk’s Office in Coventry House in London, HB’s home since 1923. Articled clerks were the ‘new boys’ and whenever a Partner came to the City office, the clerks had to move aside to give them space to work.

They were expected to be in the office before any partner arrived, could not leave until they left the office and had to work Saturday mornings. The office heating was provided by coal fire and the newest Articled clerk to join the firm had to be in early to light the fires and it was his responsibility to keep the fires going all day. All work had to be done to a very high standard: a partner checking a clerk’s work would be more likely to reject it, meaning it had to be done again.

In the 1950’s all young men were expected to undertake two years of National Service after leaving education, however, if someone was ‘serving Articles, they could apply for deferment. Having completed National Service was seen as a great training ground and HB often applied for new Articled Clerks who were due to complete their service. One such individual was Bryan Sanderson, who joined HB in 1952. All accounts were completed by hand and Bryan recalls spending most of his time “ruling off ledgers, and doing endless analysis on pub Record Books, using every column available on standard di-section paper”. The main source of work for HB at this time was for the licencing trade – one of the client’s being Davy & Company, who we still work with today.

If you’d like to learn more about our history, you can read part 1, our birth here, or read about how the 2nd World War impacted us here, or how we got our name and some of our clients here.

Chapter 5 to follow soon…

We’ve been in the accountancy business for over 100 years and today we are here to help you. Our vast experience means you have access to practical information and support no matter your business size or sector. If you would like a no obligation discussion about how we can help you and your business, please feel free to contact the team on 01992 444466. We’re accountants for business and we’re here to help you grow.

HB Accountants are here to help: giving you access to experienced accountants and useful information and support no matter your business size or sector. If you would like a no obligation discussion about how we can help you and your business, please feel free to contact the team on 01992 444466. We’re accountants for business and we’re here to help you grow.

Visit our COVID19 Business Hub for more information

View our Latest Blogs

- Celebrating Colin Wilkinson’s 60th Birthday: Do you know your accountant?

- Boris Johnson outlines new 1.25% health and social care tax to pay for reforms – National Insurance increase NICs

- 12 things your Charity needs to know about Gift Aid

- HMRC told our client to wait 6 months for tax refund to be processed – not on our watch!

- What does MTD Making Tax Digital mean for sole traders from 2023 – MTD for Income Tax

HB Accountants are not your usual accountants… see what we have been on Instagram below – & follow us on @hbahoddesdon