If an employee is provided with a car by their employer, tax is payable on the cash equivalent of the of car provided. The cash equivalent of the company car provided is calculated by taking the list price of the car, multiplied by a certain percentage, this percentage depends on the amount of carbon dioxide emitted by the car.

We blogged back in 2020 about the tax benefits of switching to fully electric vehicles, the Government is still keen to encourage all drivers to make environmentally friendly choices when it comes to choosing a car and it’s well known that tax policy drives behaviours. Rewarding drivers choosing a low emission car will spur more of us to make the change to electric.

If you’re a company director, driving an electric car is a very efficient way to extract wealth from the company. If you are using your own car then buy or lease an electric car through the company. The company will pay all of the costs, they are tax deductible and you will pay no personal tax upon it.

Check our our guide to company car and company van tax below

HB Accountants’ Guide to Company Car and Van Tax

Company Car Tax

The list price of the car is calculated using the following formula:

| £ | |

| List price when new | A |

| Add Accessories (over £100) | B |

| Less: Employee contribution (max 35,000) | (C) |

| Revised List Price | D |

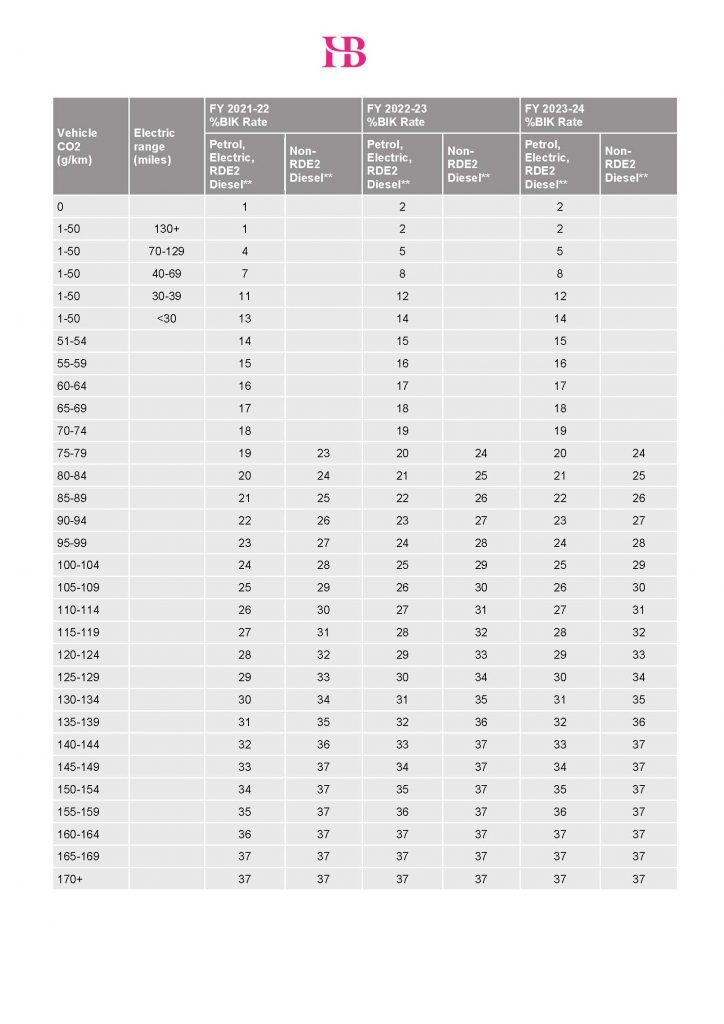

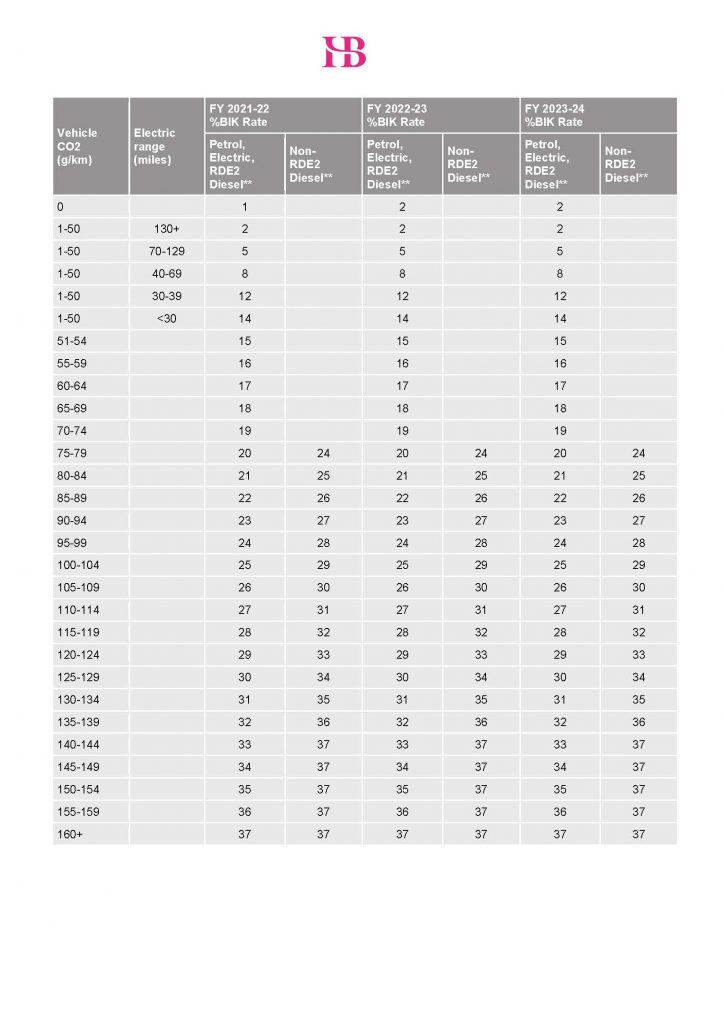

This revised list price is then multiplied by the appropriate percentage for cars registered from 6th April 2020 this as per table below:

For cars that are registered prior to 6th April 2020 the rates are slightly higher as follows:

Diesel models are subject to a 4% supplement should they not meet RDE2 tests.

37% is currently the maximum percentage that can be applied to the list price of the company car to calculate the cash equivalent of the benefit.

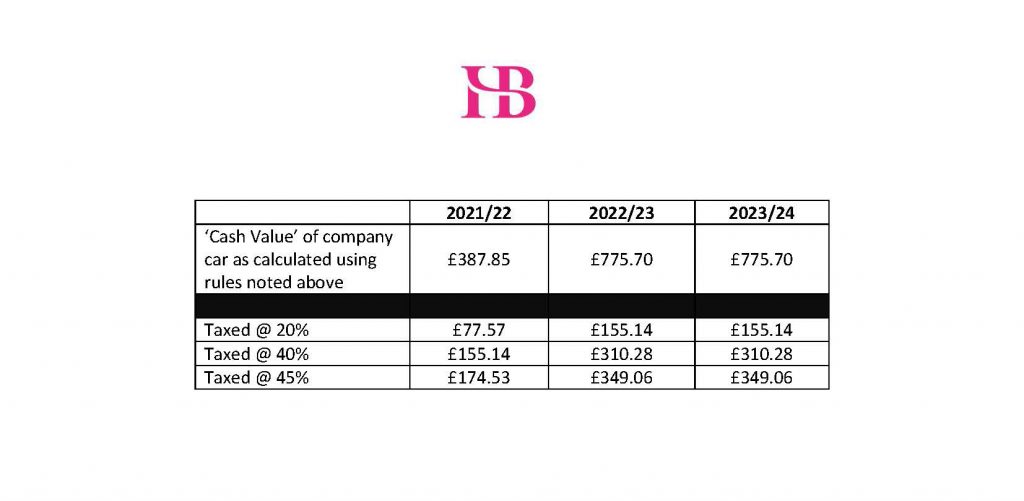

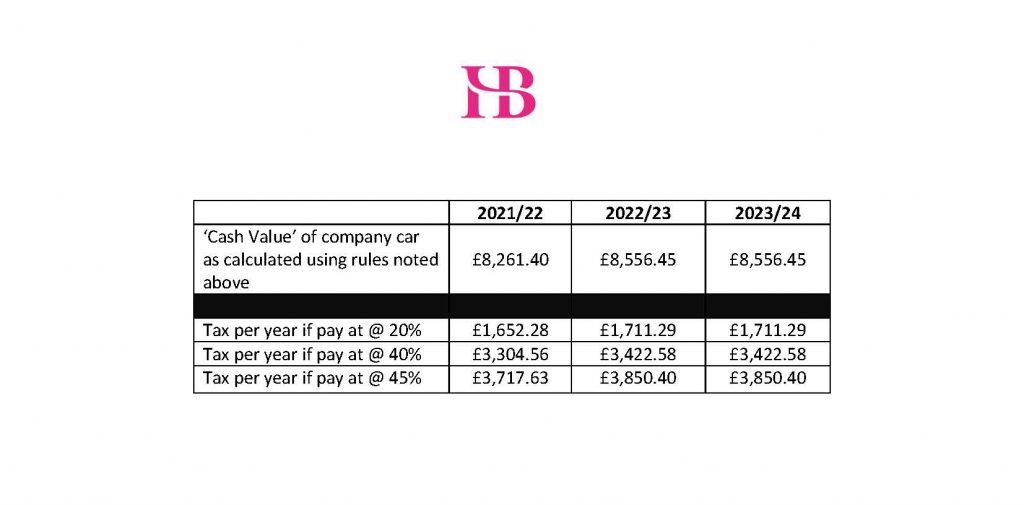

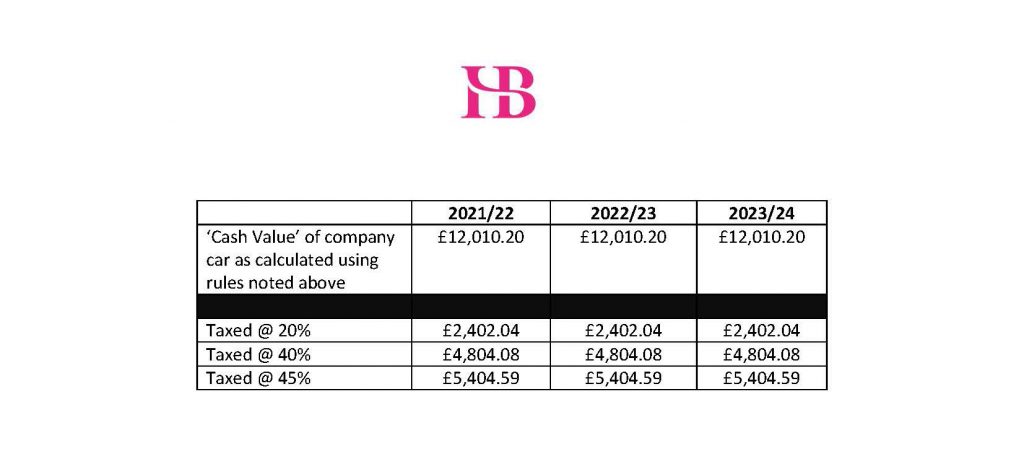

We have identified below the tax an employee provided with a company car throughout a full tax year could expect to pay on three different new models of vehicles in the 2021/22, 2022/23 and 2023/24 tax years:

BMW i3: What tax will be due?

- Fuel Type: Zero Emission

- Approximate market value: £38,785

- CO2 Emission Figure: Zero

Audi A4 Saloon (1.4 TFSI): What tax will be due?

- Fuel Type: Petrol

- Approximate market value: £29,505

- CO2 Emission Figure: 124g/km

Land Rover Discovery Sport (Pure 2.0 eD4 150hp (5 seat) 5d): What tax will be due?

- Fuel Type: Diesel

- Approximate market value: £32,460

- CO2 Emission Figure: 166 g/km

Tax implications on providing a company van for your employee or if you are a director

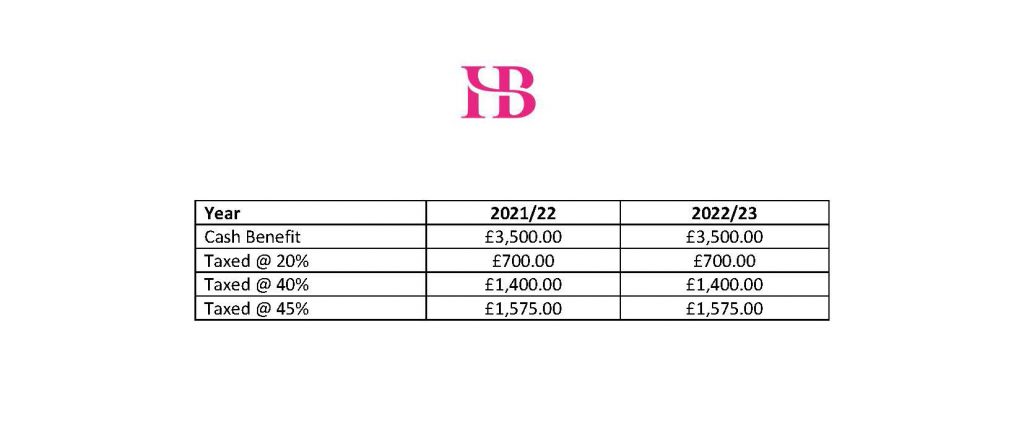

There is an income tax charge for an employee or a director who is provided by their employer or company with a company van that is made available for private use.

There is no tax charge for employee or employer where private use is insignificant, or the van is only used privately for commuting in and out of work.

The tax charge is the employee’s marginal rate of tax (i.e. 20%, 40% or 45%) times the benefit for the year in question, as outlined in the table below:

Electric vans currently have a nil taxable benefit until the 2022/23 tax year.

What can be considered a ‘Van’ for Tax Purposes?

These are the criteria that HMRC uses to classify a vehicle as a goods van:

- A vehicle primarily constructed for the conveyance of goods or burden;

- A gross vehicle weight, fully laden, not exceeding three and a half tonnes

The key term in this definition is “constructed.” In short, it is not the actual use of the vehicle, but the purpose for which it was constructed and sold that matters.

For a vehicle to class as a van there are certain structural criteria that should be met:

- The vehicle should have a significant load bay to carry goods such that the carrying of passengers can no longer be the main purpose;

- The load bay of the vehicle must not have windows

Double Cab pickups will qualify as a van if its cargo capacity/payload is over 1 tonne. A payload means the vehicle’s gross vehicle weight less its unoccupied kerb weight.

We have listed some of the Double Cab pickups that may qualify as a van within the above definition below:

- Volkswagen Amarok

- Nissan Navara

- Ford Ranger

- Isuzu D-Max

- Mitsubishi L200

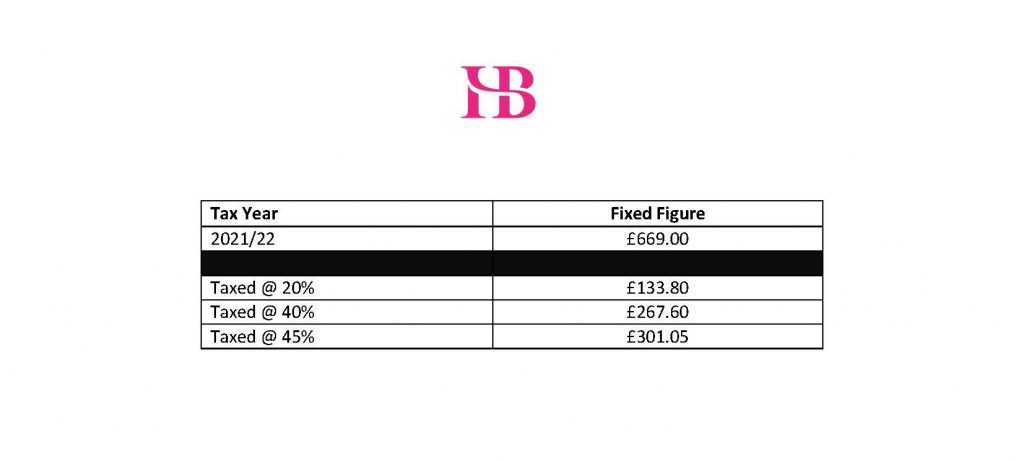

Provision of Fuel for Employees from a Tax Perspective

Employees will be taxed on fuel provided by their employers for private use. The employee will be taxed on the cash equivalent of the benefit each tax year. The fuel benefit is fixed each year, according to the table below.

| Tax Year | Fixed Figure |

| 2021/22 | £24,600 |

The fuel benefit charge is calculated by taking the appropriate percentage, as worked out for car benefit purposes, and multiplying by the fixed figure. The tax amount is then calculated by applying the individual’s marginal rate of tax to the fuel benefit charge amount.

For example, if an employee was provided with fuel for private use for a Land Rover (as above) company car the tax would be as follows:

| Tax Year | Fixed Figure | Relevant % | Taxable Amount | 20% | 40% | 45% |

| 2021/22 | £24,600 | 37% | £9,102 | £1,820.40 | £3,640.80 | £4,095.90 |

No benefit in kind will arise where fuel is provided by an employer for an electric car. Where an employee is provided with fuel for a van for private use the benefit charge is a flat rate each tax year as below:

If you would like any assistance or have any questions regarding any of the topics discussed above, please do not hesitate to contact Amy Armitage or one of the HB Accountants team on 01992 444466.

(please note figures have been rounded to the nearest pound)

Visit our COVID19 Business Hub for more information

View our latest blogs below

- How Carbon Offsetting helps business and the planet

- Employing your teenager to work for you

- How to start and run a limited company – free Companies House webinar

- Are you using all your Tax Allowances? Use Them or Lose Them – learn more here

- SEISS 5 grant applications to open in late July (Self-Employment Income Support Scheme)

The information contained above is for general guidance purposes only. Whilst every effort has been made to ensure the contents are accurate, please note that each individual has different circumstances and it is essential that you seek appropriate professional advice before you act on any of the information contained herein. HB Accountants can accept no liability for any errors or omission or for any person acting on or refraining from acting on the information provided in the above