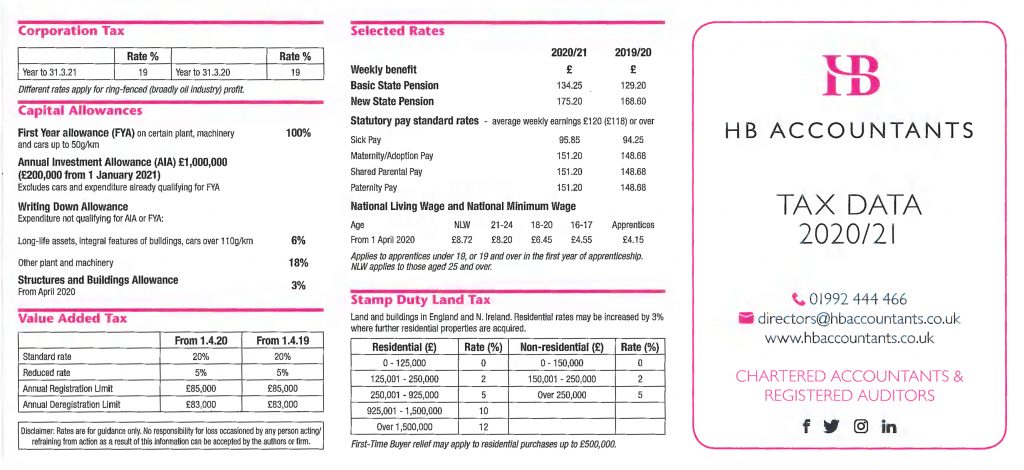

HB Accountants have produced a Tax Card which summarises many of the rates and allowances fundamental to your business and personal lives. We are sure that you will find it a useful point of reference throughout the coming tax year.

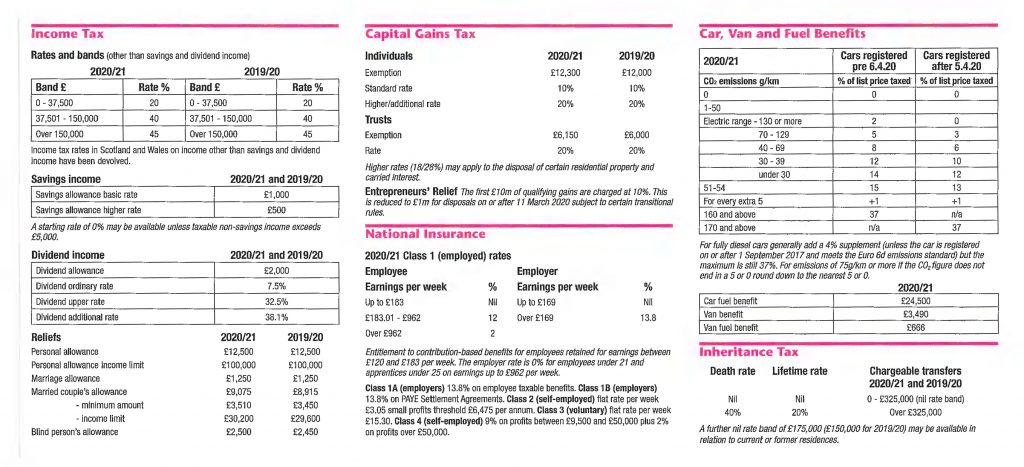

Our tax card contains lots of information on personal, business, employment, property and capital taxes, including some key recent changes:

- reduced Entrepreneurs’ Relief lifetime allowance

- significant increases in the National Insurance threshold for employee contributions

- updated car benefit percentages due to new green emissions tests

- an increase in the rate of the Structures and Buildings Allowance.

Our tax card is a double sided three way folded card intended for use as a quick point of reference. Should you require any further information, have a any question or require detailed advice we are only a phone call away – 01992 444466 – please let us know if you would like us to issue you a Tax Card in the post.

HB Accountants are accountants for business. We understand how you can make sharper, better business decisions when you really understand your business and are keen to deliver this transparency. For guidance or support, please contact Keith or Karen.

We work hard to help you make the right decisions.

Latest blogs from HB Accountants

- COVID19: Coronavirus Job Retention Scheme (CJRS) online portal opens for claims on 20 April 2020

- COVID19: Top Tips for Closed Business Premises

- HB Accountants announce winners of the “Get Creative” Dino-Egg Colouring-in Spring Art Initiative

- COVID19: £750 million coronavirus funding for frontline charities announced

- COVID19: Financial help available for self-employed individuals – what you need to know

The information contained above is for general guidance purposes only. Whilst every effort has been made to ensure the contents are accurate, please note that each individual has different circumstances and it is essential that you seek appropriate professional advice before you act on any of the information contained herein. HB Accountants can accept no liability for any errors or omission or for any person acting on or refraining from acting on the information provided in the above