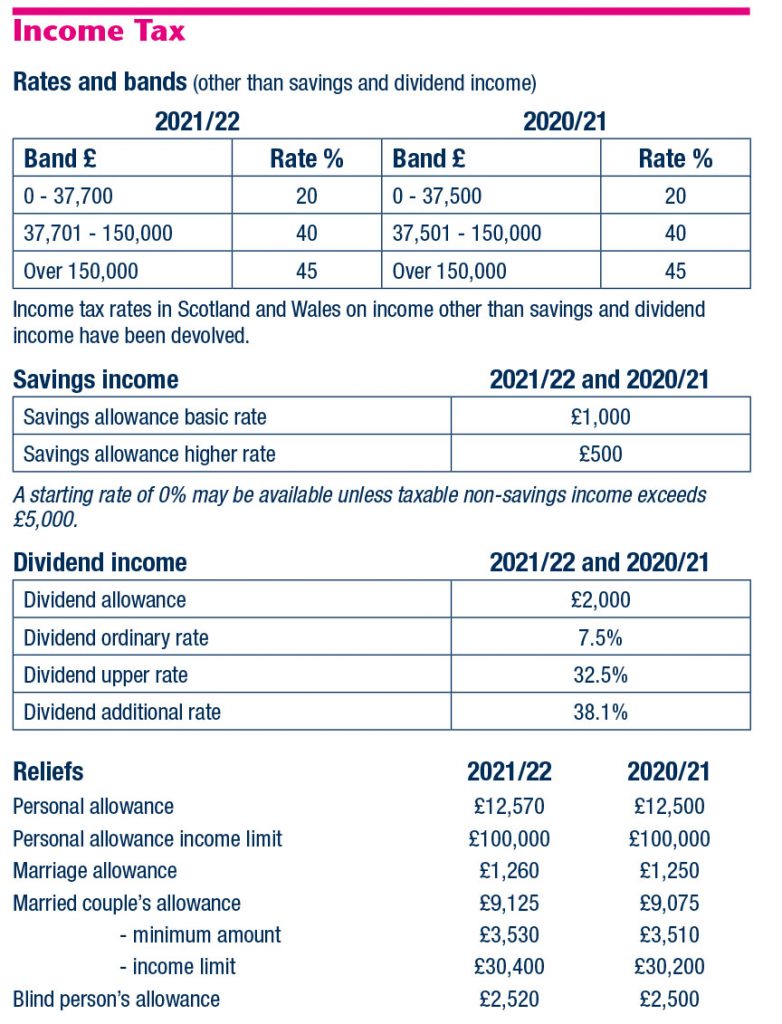

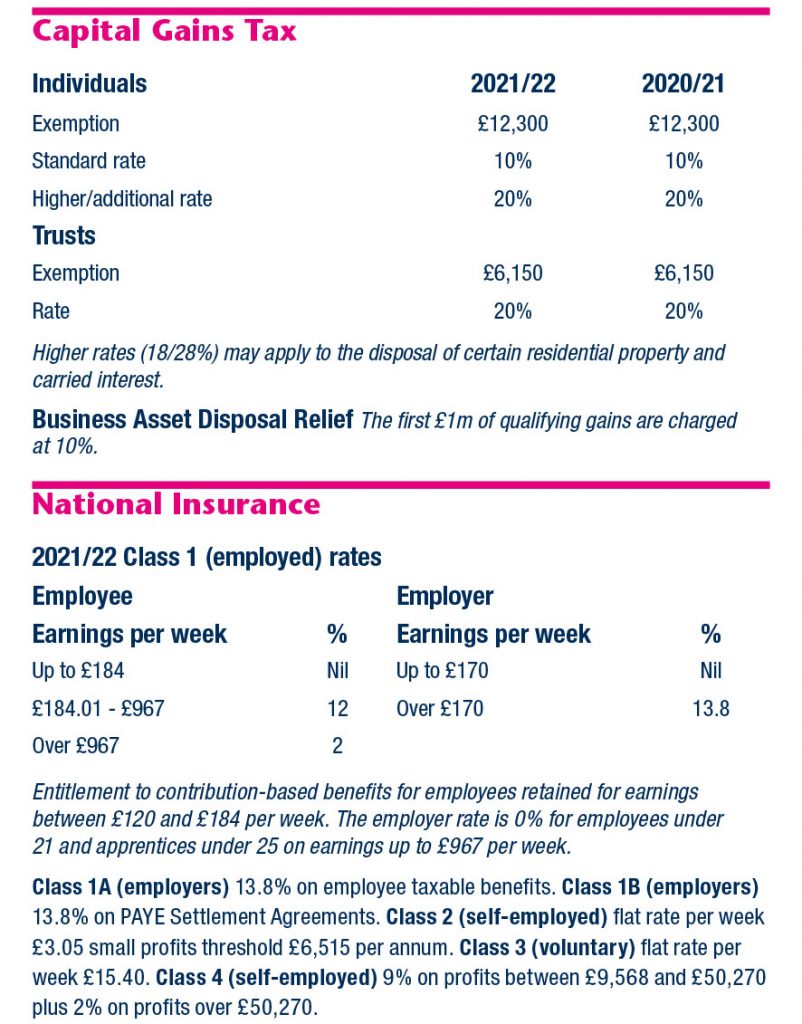

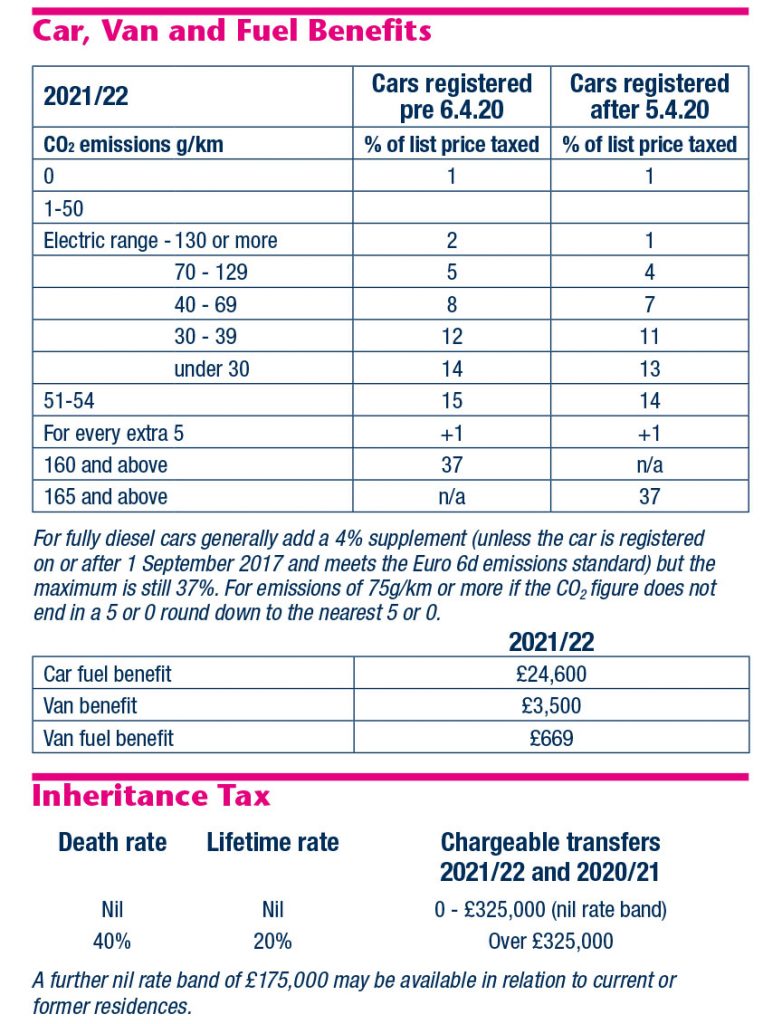

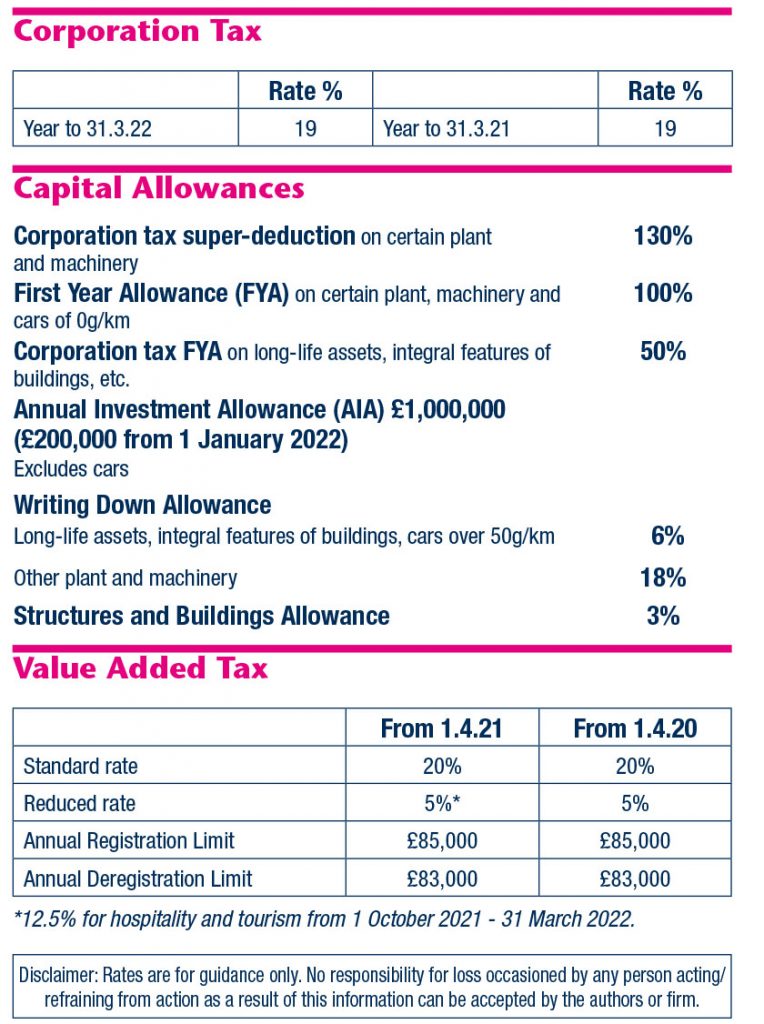

HB Accountants have produced a Tax Card which summarises many of the rates and allowances fundamental to your business and personal lives. It’s a great point of reference throughout the coming tax year and contains lots of information on personal, business, employment, property and capital taxes, including any changes.

Our guide contains information on income tax rates, including those for Scottish and Welsh taxpayers. It also includes information on devolved property taxes as well as business, employment and capital taxes applying across the UK.

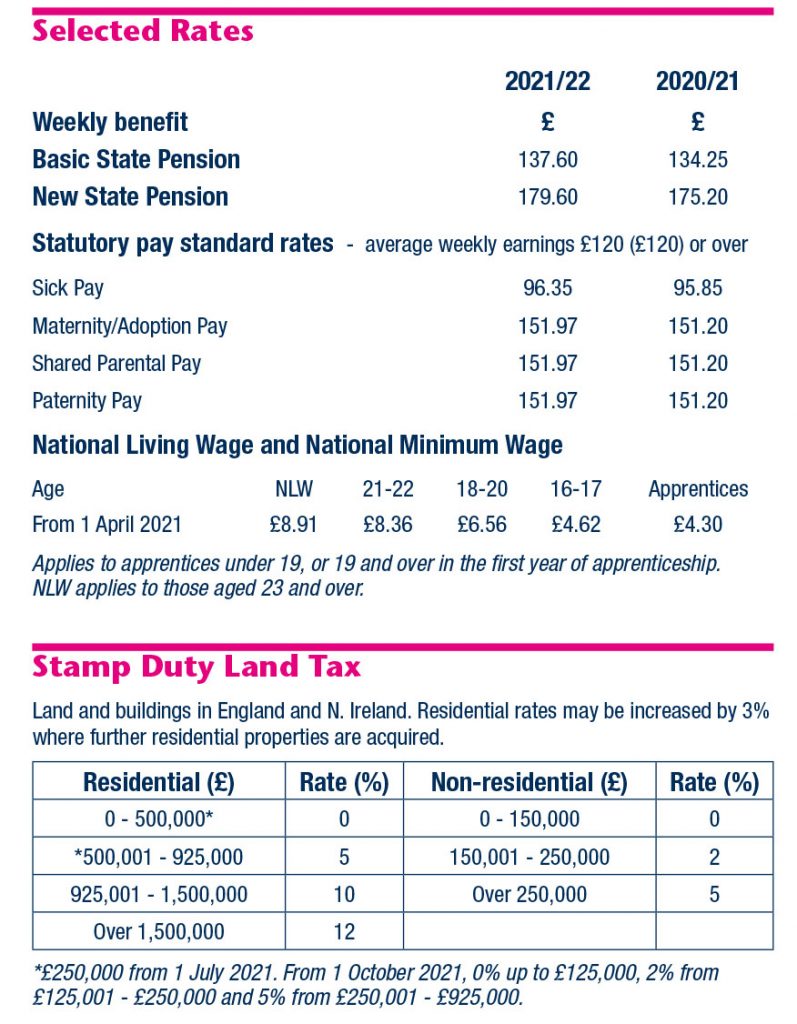

UK Tax Allowance – key recent changes include:

- increased personal allowances and tax bands

- increases in the National Insurance thresholds

- updated car benefit percentages due to new green emissions tests

- new super-deduction first year capital allowances for companies

- revised property taxes

Our tax card is a double sided three way folded card intended for use as a quick point of reference. Should you require any further information, have a any question or require detailed advice we are only a phone call away – 01992 444466 – please let us know if you would like us to issue you a Tax Card in the post.

HB Accountants are accountants for business. We understand how you can make sharper, better business decisions when you really understand your business and are keen to deliver this transparency. For guidance or support, please contact Keith or Karen.

We have been working hard to continue to keep you updated as the Government releases new information and are doing everything we can to support our clients during this uncertain period, please do not hesitate to contact us here if you have any concerns or queries and why not check our our COVID19 Business Hub for the very latest updates.

Visit our COVID19 Business Hub for more information

Latest blogs from HB Accountants

- HMRC Advisory Fuel Rates (AFRs) from 1st June 2025

- How an audit can help your business (and actions you can take to make it go smoothly too!)

- Why a budget helps you to focus on business growth

- How a SME Owner Can Create More Time

- A New Academic Year for our Student in Zambia

The information contained above is for general guidance purposes only. Whilst every effort has been made to ensure the contents are accurate, please note that each individual has different circumstances and it is essential that you seek appropriate professional advice before you act on any of the information contained herein. HB Accountants can accept no liability for any errors or omission or for any person acting on or refraining from acting on the information provided in the above