The SEISS fifth grant period ends today as does the furlough scheme, with employers having until 14 October to submit a claim for the latter – as does the VAT reduction for hospitality and tourism to 5%, which will see an increase to 12.5

The ICAEW have issued a handy timeline for the remaining schemes.

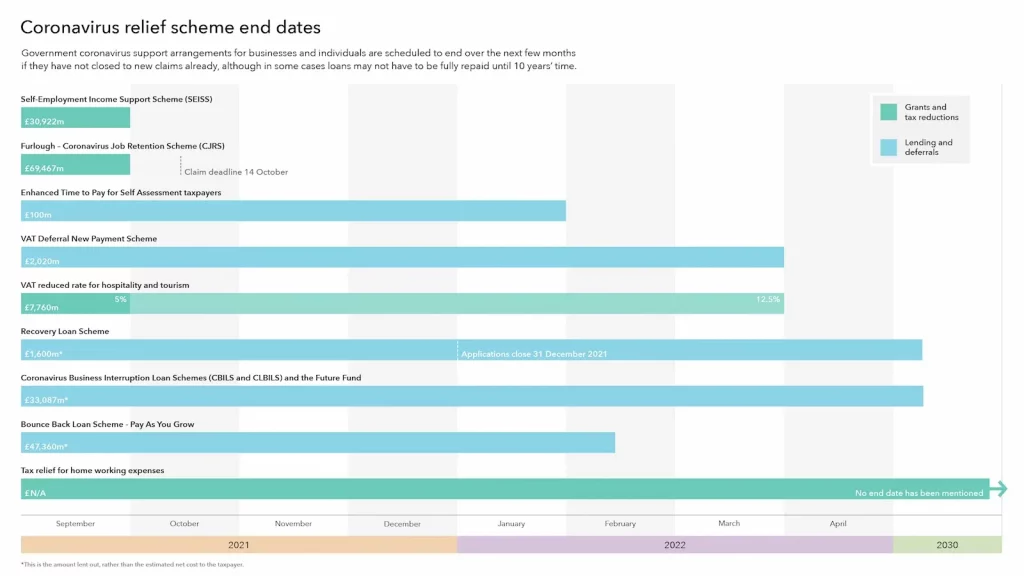

Two forms of data are shown in the chart: how much money has been spent or lent on each scheme so far, and each scheme’s end date.

The chart does not include all of the support measures provided by the government or the Bank of England to businesses and individuals, for example the £20 a week uplift in universal credit to those on low incomes that also comes to an end on 30 September or the corporate finance lending facilities provided by the Bank of England to very large businesses.

COVID support schemes shown in the chart:

The Self-Employment Income Support Scheme (SEISS):

Started on 4 May 2020, when HMRC contacted taxpayers who were eligible to claim a taxable grant worth 80% of their average trading profits up to a maximum of £7,500 (equivalent to three months’ profits), paid in a single instalment. The SEISS scheme continued for up to five grants across the course of the pandemic, with varying percentages being paid out for each grant (determined by how much turnover has been reduced in the year April 2020 to April 2021). Applications for the fifth grant must be made on or before 30 September 2021.

The furlough or Coronavirus Job Retention Scheme (CJRS):

Has been extended several times, with the final extension being to 30 September 2021. For claims relating to August and September 2021, the government will pay 60% of wages up to a maximum cap of £1,875 for the hours the employee is on furlough. The final claim date is 14 October 2021.

Enhanced Time to Pay for Self Assessment taxpayer:

Allowed taxpayers to defer their 2020 income tax payments until January 2021. Then using HMRC’s Time to Pay facility they could pay the deferred 2020 tax bill plus the 2021 tax bill up until January 2022.

The VAT Deferral New Payment Scheme:

Introduced in the initial COVID relief measures, allowed VAT-registered businesses to defer VAT due for March – June 2020 until March 2021 interest-free. This payment could be spread across the 2021-22 fiscal year.

The VAT reduced rate for hospitality and tourism:

Was part of the government’s initial coronavirus relief measures. This meant businesses could apply a 5% reduced rate of VAT, reducing the cost to consumers with a view to encouraging them to spend more. This scheme runs at a 5% reduction rate until 30 September, followed by a 12.5% rate until 31 March 2022 when the scheme ends, and the rate reverts to the standard VAT rate of 20%.

The Recovery Loan Scheme:

Was launched on 6 April 2021 and remains open for new applications until 31 December this year. It provides bank overdrafts and invoice finance from £1,000 to £10m for up to three years, and loans and asset finance from £25,001 to £10m for up to six years. These are subject to credit checks given that the government has only provided 80% guarantees and the banks concerned are on the hook for the rest.

Bounce Back Loan Scheme (BBLS) – Pay As You Grow

Was also part of the initial COVID measures which offered financial support of up to £50,000 for businesses negatively affected by the pandemic. As businesses began to emerge from COVID they used the Pay As You Grow function to make interest-only payments towards the BBLS loans they received for up to six months. As late as November/December 2030 if the business was granted a loan on the application deadline.

Coronavirus Business Interruption Loan Schemes (CBILS and CLBILS) and the Future Fund:

Provided support in the form of loans for a range of company sizes through the state-owned British Business Bank for periods of three or six years. They closed to new applications earlier this year. In the case of the Future Fund, loans are convertible to equity in certain circumstances, with the government having already acquired shareholdings in 158 businesses as of 31 August 2021.

We would like to thank the ICAEW for the information above: ICAEW Insights sourced the data for this chart from the National Audit Office’s COVID-19 cost tracker. The tracker is an interactive tool that brings together data from across the UK government. It provides estimates of the cost of measures announced in response to the coronavirus pandemic and how much the government has spent on these measures so far where this information is publicly available or has been provided to the NAO by government departments.

Please feel free to contact the team on 01992 444466. We’re accountants for business and we’re here to help you grow.

Visit our COVID19 Business Hub for more information

Read our latest blogs below

- HB Accountants Leads Installation of Life-Saving Defibrillator in Rye House, Hoddesdon

- Cyberattacks – why FDs and CIOs need to collaborate

- Why and How to Verify Your Identity with Companies House – A Must for Company Directors and PSCs

- HB Accountants Launches Inspiring Work Experience Initiative Across Borough of Broxbourne and We’re Just Getting Started!

- Hello from Livingstone! Talking to Gertrude

The information contained above is for general guidance purposes only. Whilst every effort has been made to ensure the contents are accurate, please note that each individual has different circumstances and it is essential that you seek appropriate professional advice before you act on any of the information contained herein. HB Accountants can accept no liability for any errors or omission or for any person acting on or refraining from acting on the information provided in the above