Daily COVID-19 Update 23rd March 2020 – Support for businesses through the Coronavirus Job Retention Scheme. Under the Coronavirus Job Retention Scheme, all UK employers will be able to access support to continue paying part of their employees’ salary for those employees that would otherwise have been laid off during this crisis.

All UK businesses are eligible for this scheme.

How to access the scheme

you will need to:

1) Designate affected employees as ‘furloughed workers,’ and notify your employees of this change – changing the status of employees remains subject to existing employment law and, depending on the employment contract, may be subject to negotiation

2) Submit information to HMRC about the employees that have been furloughed and their earnings through a new online portal

HMRC will reimburse 80% of furloughed workers wage costs, up to a cap of £2,500 per month. HMRC are working urgently to set up a system for reimbursement.

As soon as we receive further information we will be in touch with our clients.

Deferring VAT and Income Tax Payments

VAT

For VAT, the deferral will apply from 20 March 2020 until 30 June 2020.

This is an automatic offer with no applications required. Businesses will not need to make a VAT payment during this period. Taxpayers will be given until the end of the 2020 to 2021 tax year to pay any liabilities that have accumulated during the deferral period. VAT refunds and reclaims will be paid by the government as normal.

At this stage, we would advise that you submit your VAT return as normal, but cancel your direct debit to pay the VAT owed if you have one set up – we are awaiting further guidance on this.

Income Tax

For Income Tax Self-Assessment, payments due on the 31 July 2020 will be deferred until the 31 January 2021.

If you are self-employed you are eligible.

This is an automatic offer with no applications required. No penalties or interest for late payment will be charged in the deferral period.

Support for businesses who are paying sick pay to employees

HMRC have brought forward legislation to allow small and medium-sized businesses and employers to reclaim Statutory Sick Pay (SSP) paid for sickness absence due to COVID-19. The eligibility criteria for the scheme will be as follows:

- This refund will cover up to 2 weeks’ SSP per eligible employee who has been off work because of COVID-19

- Employers with fewer than 250 employees will be eligible – the size of an employer will be determined by the number of people they employed as of 28 February 2020

- Employers will be able to reclaim expenditure for any employee who has claimed SSP (according to the new eligibility criteria) as a result of COVID-19

- Employer should maintain records of staff absences and payments of SSP, but employees will not need to provide a GP fit note. If evidence is required by an employer, those with symptoms of coronavirus can get an isolation note from NHS 111 online and those who live with someone that has symptoms can get a note from the NHS website

- Eligible period for the scheme will commence the day after the regulations on the extension of SSP to those staying at home comes into force

- The government will work with employers over the coming months to set up the repayment mechanism for employers as soon as possible.

Eligibility

You are eligible for the scheme if:

your business is UK based your business is a small or medium-sized and employs fewer than 250 employees as of 28 February 2020

How to access the scheme

A rebate scheme is being developed – we will provide further details to our clients as soon as we can.

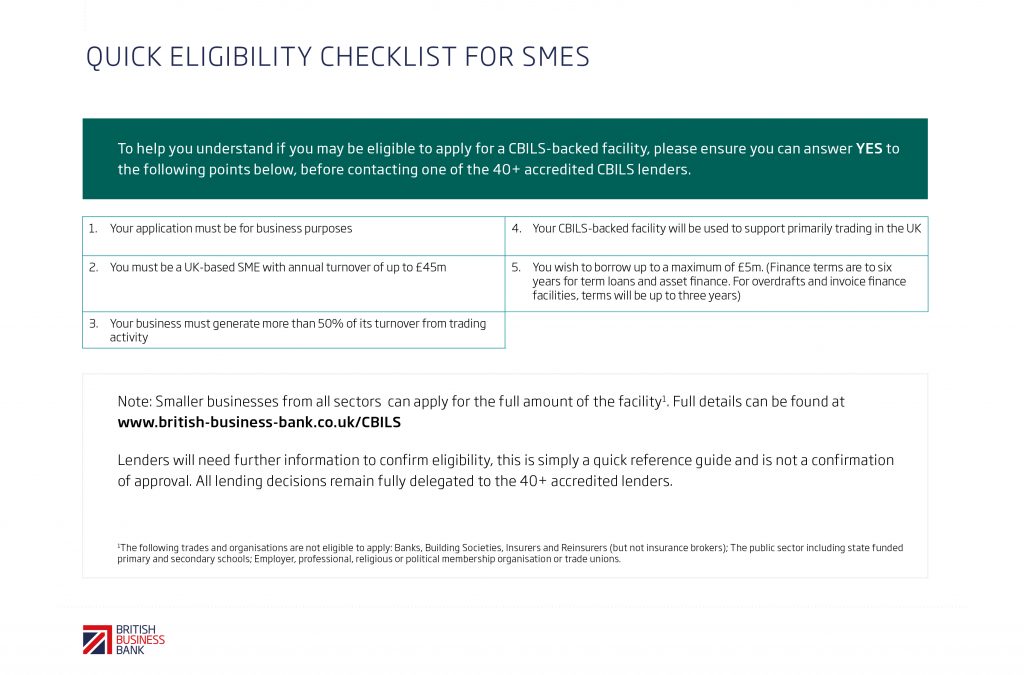

| Support for businesses through the Coronavirus Business Interruption Loan Scheme New guidance has been released by the British Business Bank on the scheme: Key features and eligibility criteria: https://www.british-business-bank.co.uk/ourpartners/coronavirus-business-interruption-loan-scheme-cbils/ How to apply: https://www.british-business-bank.co.uk/ourpartners/coronavirus-business-interruption-loan-scheme-cbils/for-businesses-and-advisors/ Accredited Lenders: https://www.british-business-bank.co.uk/ourpartners/coronavirus-business-interruption-loan-scheme-cbils/accredited-lenders/ FAQ document: https://www.british-business-bank.co.uk/wp-content/uploads/2020/03/British-Business-Bank-CBILS-FAQs-for-SMEs-FINAL.pdf Please see a quick eligibility checklist below; |

| These loans will now be interest-free for 12 months. Help for Self-employed A quick checklist of the current help for self-employed individuals are below: Suspension of the minimum income floor for the self-employed: self-employed people can now access, in full, Universal Credit at a rate equivalent to Statutory Sick Pay for employees HMRC universal credit website: https://www.gov.uk/universal-credit Next self-assessment payment on account have been deferred to 31st Jan 2021 for the self-employed Universal Credit – standard allowance is to rise over the next 12 months by £1,000, the same rise also applies for those on the working tax credit scheme Nearly £1bn for those struggling to pay rent, through increases in housing benefit and Universal Credit We are expecting more support measures for the self-employed to be released either today or tomorrow. We have noted that an incorrect number for a HMRC helpline is being shared and reshared on social sites. Please note we have spoken with HMRC today and this helpline does not exist as of yet. HMRC are waiting for further guidance from the government. The only HMRC helpline that currently exists in relation to the COVID-19 situation is: 0800 0159 559 – this is a helpline for those who need to delay tax payments in relation to the situation. Grants We have had an update from the local council, they expect to receive the funding to begin to issue these grants at the beginning of April. If you have any queries please contact your local authority. You cannot apply for these grants – your local authority will contact you if you are eligible. Team HB will be updating our clients and contacts as the government released new information – we want to assure you that we will be here throughout this crisis for our clients and contacts, if you have any concerns at all please do not hesitate to contact us. Our business contingency plan is in place and we will do everything we can to support our clients during this uncertain period, please do not hesitate to contact us here by email or call 01992 444466 if you have any concerns or queries regarding the above or anything to do with the COVID-19 outbreak. We are here for you during this difficult time. If you missed our earlier mail out on “What you can do to help your business/sole trade through the COVID-19 crisis” please click here. Stay safe & healthy & please do call us if you just need to talk The whole team at HB Accountants |

Visit our COVID19 Business Hub by clicking here

The information contained above is for general guidance purposes only. Whilst every effort has been made to ensure the contents are accurate, please note that each individual has different circumstances and it is essential that you seek appropriate professional advice before you act on any of the information contained herein. HB Accountants can accept no liability for any errors or omission or for any person acting on or refraining from acting on the information provided in the above

Pingback: COVID-19: 27th March 2020 – Help for the Self-Employed - HB Accountants

Pingback: COVID19: Immediate 3-month filing extension for company accounts - HB Accountants

Pingback: COVID19: VAT deferral for UK Businesses - HB Accountants

Pingback: COVID19 Update: Support for businesses through deferring Self-Assessment payments on account - HB Accountants

Pingback: COVID19 update: Payroll Furlough Facts - Coronavirus Job Retention Scheme - HB Accountants

Pingback: COVID19: Changes made to Coronavirus Business Interruption Loan Scheme to benefit more businesses - HB Accountants

Pingback: COVID19: Financial help available for Self-Employed - what you need to know - HB Accountants

Pingback: COVID19: Latest Job Retention Scheme updates - furlough facts - HB Accountants