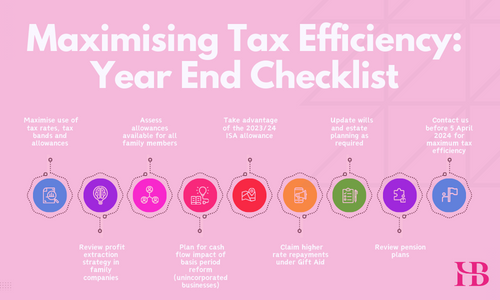

As we near the end of the tax year on 5 April 2024, it’s essential to take stock of your family and business finances. Although tax rates and thresholds remain stagnant, the government’s tax revenue keeps climbing. Nonetheless, there are still plenty of practical ways to manage your affairs tax-efficiently, and we’re here to guide you through some of these strategies.