As we near the end of the tax year on 5 April 2024, it’s essential to take stock of your family and business finances. Although tax rates and thresholds remain stagnant, the government’s tax revenue keeps climbing. Nonetheless, there are still plenty of practical ways to manage your affairs tax-efficiently, and we’re here to guide you through some of these strategies.

Year End Tax Planning Guide – things to consider for the 23-24 tax year

■ Tax rates and allowances

■ Tax and the family

■ Family companies: assess profit extraction strategy

■ Keep up to date with pension planning opportunities

■ Unincorporated businesses: plan for major change

■ Invest tax efficiently

■ Take stock of capital gains tax rules and changes

■ Use Gift Aid effectively

■ Year end checklist

Year End Tax Planning Guide

HB Accountants Top Tips for Tax Planning pre 5 April 2024

Personal Tax Planning Tips

- Tip: Can you retain the personal allowance?

- Tip: Dividend Allowance is more generous before April 2024

- Tip: Pension planning in family

companies - Tip: Watch for Child Benefit charge

- Use Gift Aid to reduce taxable income

Unincorporated Business: plan for major change

Be aware from 6 April 2024, there is a change to the way that business trading

income is allocated to tax years for income tax purposes: ‘basis period

reform’. This means that businesses are taxed on the profits arising

in the tax year, rather than their accounting year.

Take stock of capital gains tax rules and changes

Capital gains tax (CGT) is charged at 10% (18% on residential property) for UK basic

rate taxpayers; and 20% (28% on residential property) for UK higher and additional rate

taxpayers. Scottish taxpayers pay CGT based on UK rates and bands, and therefore need to assess their position based on UK rates.

CGT Tip: More than one home?

Married couples can only count one property as their main residence for CGT purposes. This can be problematic if both parties are homeowners. In this situation, it’s possible to decide which of the two properties you wish to nominate

Be aware of rules on cryptoassets

HMRC has recently launched a new service to allow someone to voluntarily disclose any unpaid tax on income or gains from cryptoassets, including exchange tokens, such as bitcoin, non-fungible tokens and utility tokens. The service is essentially designed to bring someone’s affairs up to date where transactions giving rise to capital gains were made in the

past, rather than in the current tax year. We would always recommend professional advice before using HMRC disclosure facilities like this.

Gift Aid – are you paying tax at more than basic rate?

Did you know that if you pay tax at more than basic rate, a payment under Gift Aid should result in a tax refund? This is because you are entitled to tax relief at your top rate of tax on the donation. This means you get the difference between the basic rate tax paid on the donation, and higher rate tax on the donation.

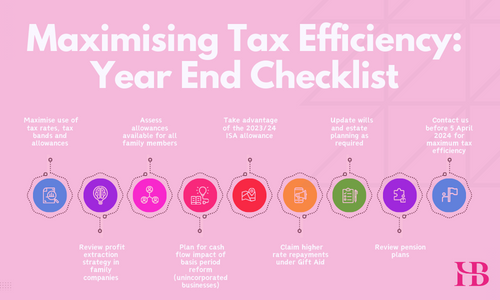

Year end checklist pre 5 April 2024

- Maximise use of tax rates, tax bands and allowances

- Assess allowances available for all family members

- Review profit extraction strategy in family companies

- Plan for cash flow impact of basis period reform (unincorporated businesses)

- Take advantage of the 2023/24 ISA allowance

- Claim higher rate repayments under Gift Aid

- Review pension plans

- Update wills and estate planning as required

- Contact us before 5 April 2024 for maximum tax efficiency

The information contained above is for general guidance purposes only. Whilst every effort has been made to ensure the contents are accurate, please note that each individual has different circumstances and it is essential that you seek appropriate professional advice before you act on any of the information contained herein. HB Accountants can accept no liability for any error

Read Our Latest Blogs Below

- Are you part of the Apprenticeship Ambassador Network (AAN)? HB Accountants share the benefits here

- Why training future accountants and business professionals is an integral part of HB Accountants business

- New laws to fight corruption, money laundering and fraud may impact how Directors interact with Companies House

- Unbelievable excuses for tax returns that miss the Jan 31st filing deadline

- Advisory Fuel Rates for Company Car Users: When You Can Use Them