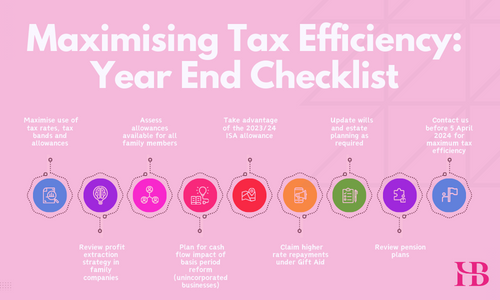

Following the success of our previous episodes, HB Accountants is excited to announce Episode 3 of our podcast series: Year End Tax Planning Tips for Individuals. This installment is dedicated to helping individuals navigate the complexities of personal tax planning as the fisccal year draws to a close.