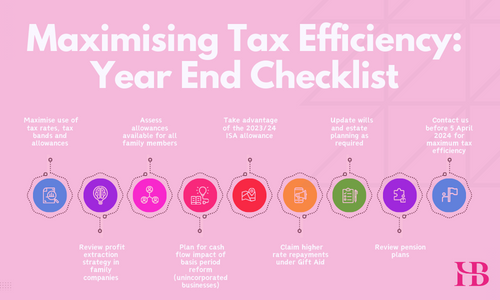

Changes to National Insurance contributions (NICs) and tax policies have been announced by the Chancellor. Take a look at the upcoming adjustments, including reductions in NICs rates for employees and the self-employed, changes to Capital Gains Tax rates, the introduction of a new British ISA allowance, updates to VAT registration thresholds, and plans to extend Full Expensing to leased assets. These changes are effective from 6 April 2024 and aim to support individuals and foster investment in promising UK enterprises.