A number of children currently in year 11 at school, who are turning 16 years old, have not received a National Insurance number. This is why.

A number of children currently in year 11 at school, who are turning 16 years old, have not received a National Insurance number. This is why.

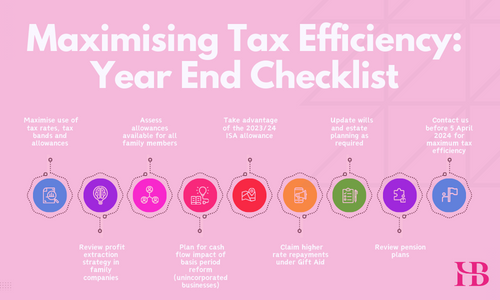

As we near the end of the tax year on 5 April 2024, it’s essential to take stock of your family and business finances. Although tax rates and thresholds remain stagnant, the government’s tax revenue keeps climbing. Nonetheless, there are still plenty of practical ways to manage your affairs tax-efficiently, and we’re here to guide you through some of these strategies.

The 17th National Apprenticeship Week runs between 5 – 11th February, 2024. It’s a week-long celebration when businesses and apprentices shine a light on the positive impact that apprenticeships make to individuals, businesses and the wider economy. This year’s theme is #SkillsForLife – and when we review our own apprenticeship experience, we can see the newly acquired skills in action and the difference that they are making.

Understanding whether a business is profitable or not is fundamental to the success of the business. If you are a business owner, you need to know what to do to maximise your profits or whether there are areas that need more attention. This is why regularly creatin and understanding your Profit and Loss (P&L) is so important.

Whether you’re just considering a new business idea or already transact as a sole trader, you may wonder if incorporating your business – that is becoming a Limited Company – is right for you. In order to know the answer, you need to research the differences between the two structures, and we highly recommend speaking to your accountant, as there will be tax implications.

Benefits-in-kind can feel like a minefield for business owners. In this blog we will tell you what you need to know, what you need to do, and show that it is possible to reward your team for doing a brilliant job without being taxed for it!

We are thrilled to announce that HB Accountants has been awarded the 23rd position in the prestigious list of Top 50 SME Apprenticeship Employers for 2023. This recognition was celebrated at a special event at the House of Commons on September 12th, 2023, attended by our marketing manager, Vicki, who collected the award on behalf of HB Accountants

There are over 400,000 charities in the UK working hard to benefit different segments of society. You may be aware of a gap in provision and have the passion and drive to start up a new charity. This is what you need to do to establish your charity and the laws that govern charities in the UK.

Continue reading

If a business trip takes you into the new London ULEZ and it is entirely for business reasons, then it is likely that any charges incurred by driving in a non-compliant car may be claimed in your tax return.

Continue readingThere is a new digital platform available now on GOV.UK that is revolutionising the way businesses can search for and apply for government grants.

© 2025 HB Accountants | Privacy Policy | Disclaimer | Terms of use | Website by Origin 1

HB Accountants is the trading name of HBAS Limited, a company registered in England with registration number 5085258. The registered office of HBAS Limited is Plumpton House, Plumpton Road, Hoddesdon, Hertfordshire EN11 0LB, England. Registered for VAT number 866062806.